By Robert Kale and Jock Purtle

You have been building an Ecommerce business that you’ve put a lot of time, effort, and sweat equity into growing, and now you’re looking to sell. Your objective is to get maximum value and you’re assessing steps to prepare for the sale. There are a multitude of variables to consider and in this post, we’ll cover them all to maximize the price you receive when exiting. Keep in mind: the insights in this article are not inclusive of Amazon FBA business sales, this is only for standalone Ecommerce websites. If you want to learn more about selling an Amazon FBA business, our insights article is here.

Let’s get right into it.

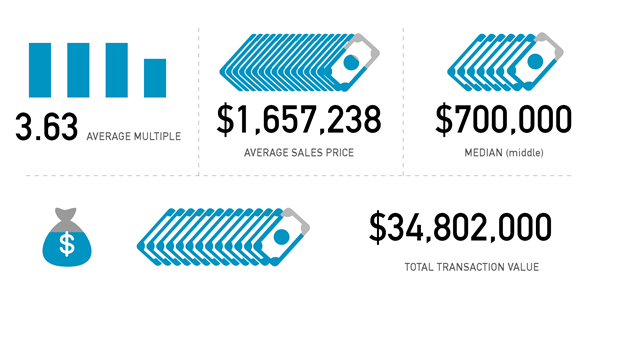

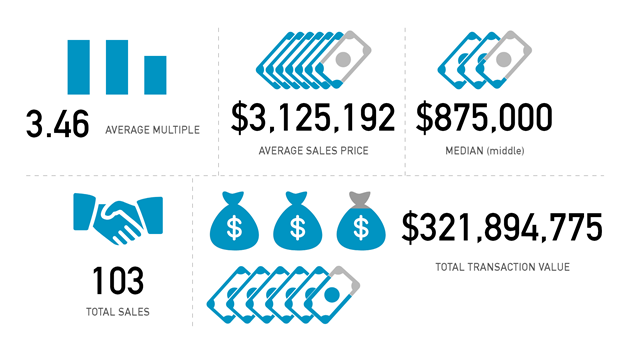

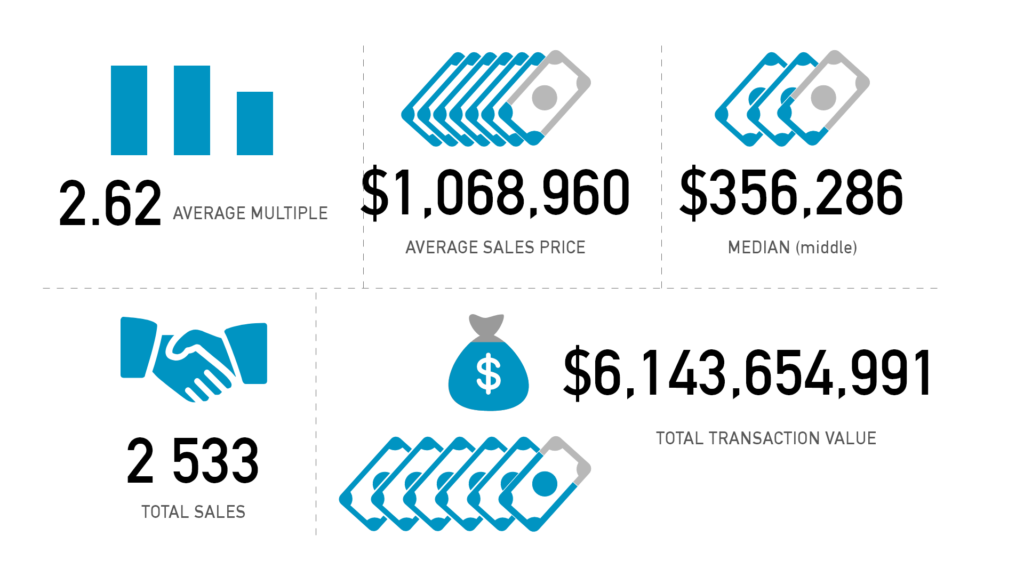

We Analyzed 215 Ecommerce Sales in 2021. Here’s What We Found:

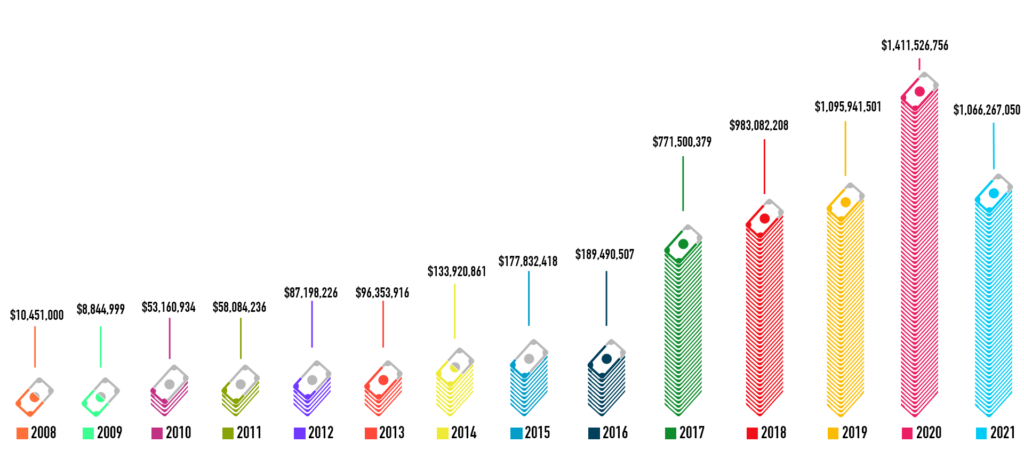

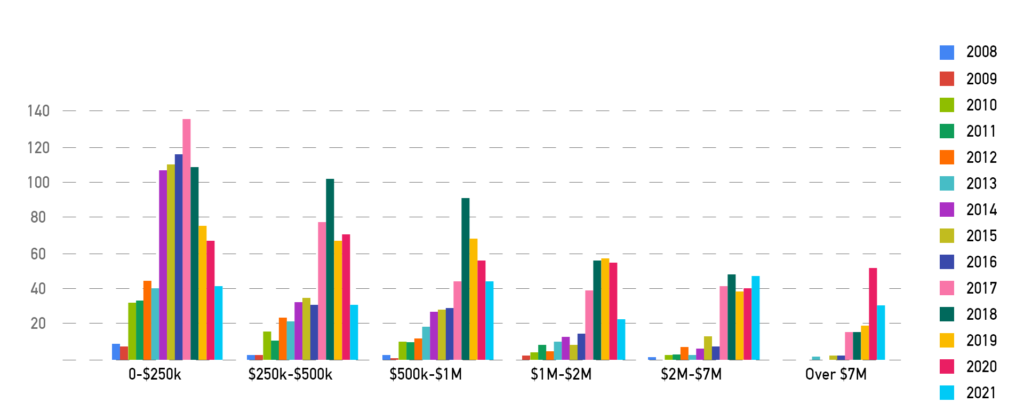

The biggest takeaway — there were less deals overall in 2021 (the least since 2016) and this affected transactions of all sizes. The categories that saw the least decline most were deals in the $2M+ range. Since our data is based on listings, we can’t assume 1) they all closed, and furthermore 2) they closed at the listing prices. So, we will go through some statistics that show big upticks in deal sizes and multiples, and keep in mind this is a result of many more high value Ecommerce listings in 2021 compared to previous years.

- The average multiple for standalone Ecommerce sites was 3.49x, a slight jump from 3.41x in 2020.

- Larger businesses still commanded the highest multiple (see multiples graph further down) but businesses selling for over $250K continued to rise as well.

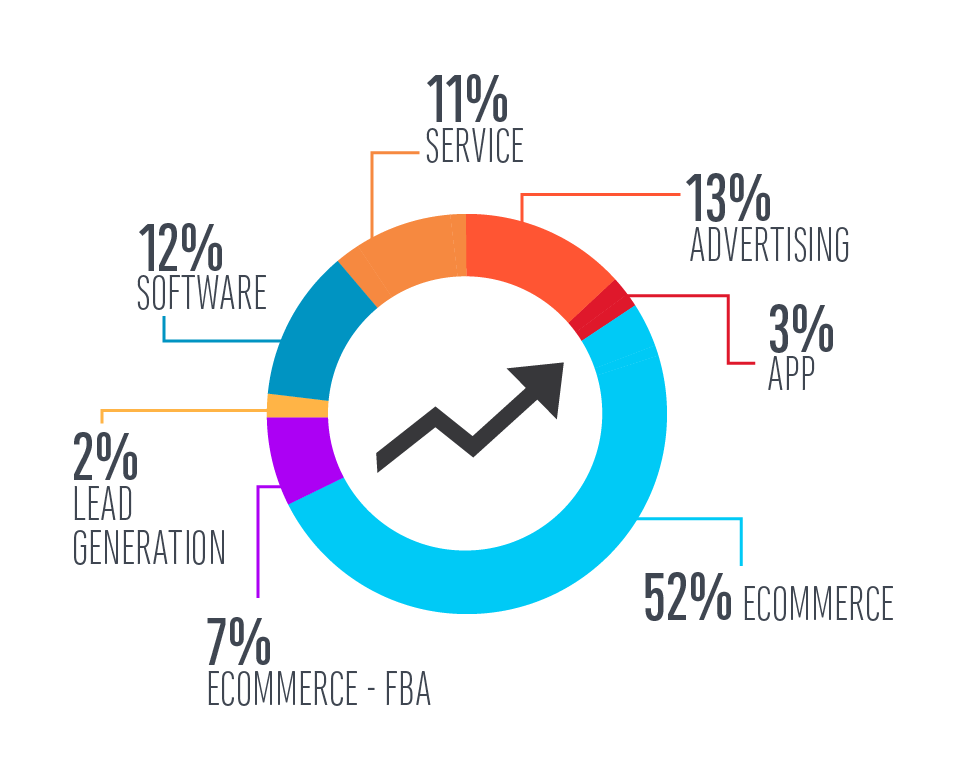

- Ecommerce continues to be the dominant category in the market, with a whopping 81% of all business sales being standalone Ecommerce websites for 2021.

What Are The Market Trends?

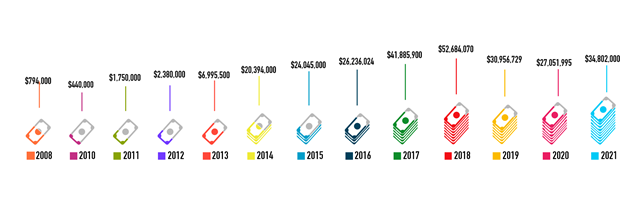

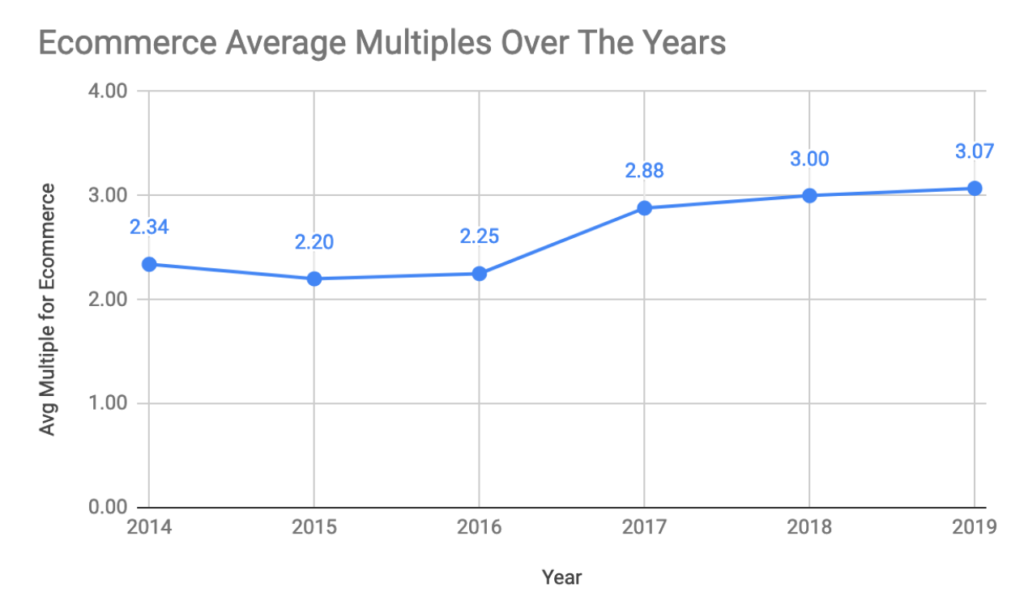

2021 had an explosion of high-price Ecommerce listings, with many more Ecommerce businesses listed over $7M asking price. With higher earnings, Ecommerce businesses can command higher multiples, so we saw the continued increase in average ecommerce multiples as more businesses reach higher earnings and listing prices:

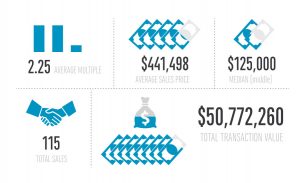

| Year | Avg Multiple for Ecommerce |

| 2014 | 2.34 |

| 2015 | 2.20 |

| 2016 | 2.25 |

| 2017 | 2.88 |

| 2018 | 3.00 |

| 2019 | 3.07 |

| 2020 | 3.41 |

| 2021 | 3.49x |

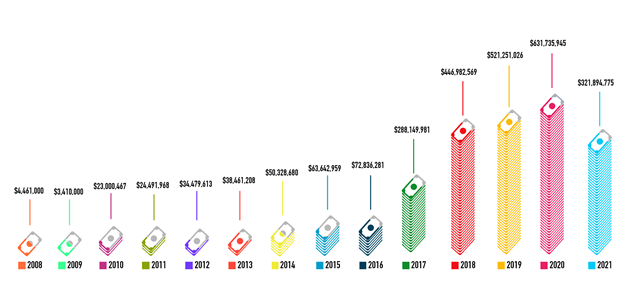

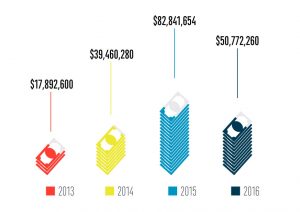

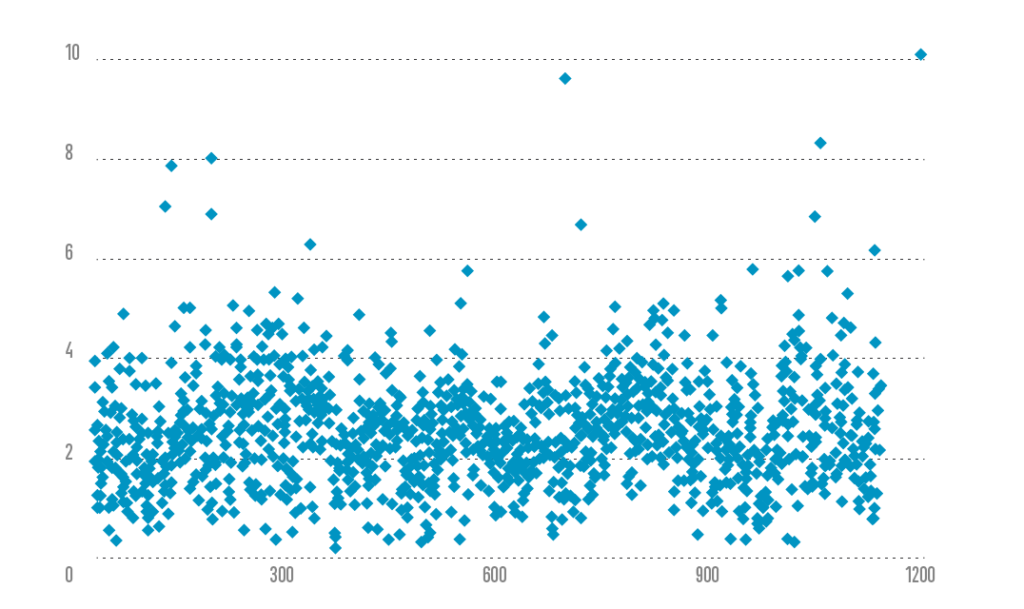

Transaction volume for Ecommerce:

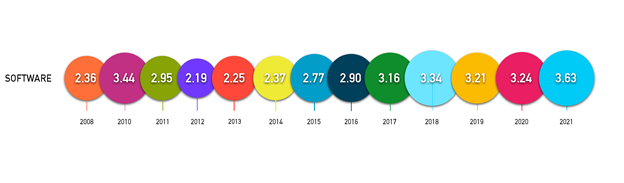

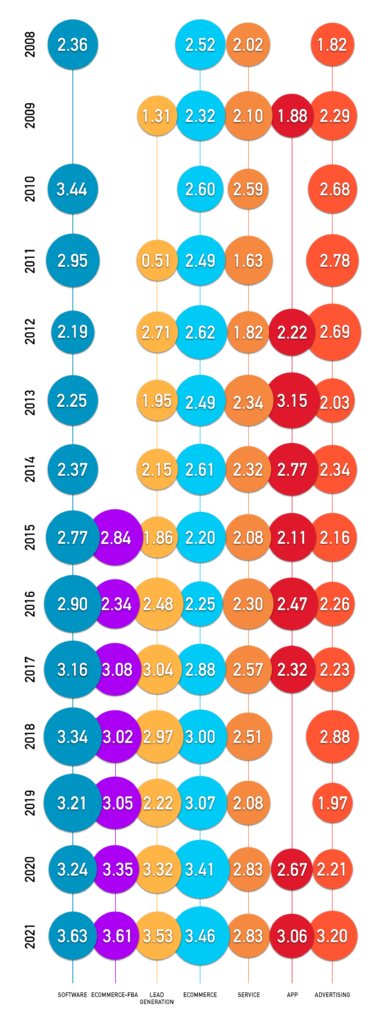

What Has the Average Sales Multiple Been Per Year?

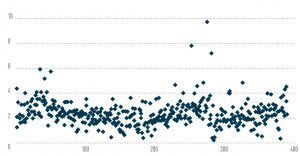

Ecommerce businesses can sell for as little as a few thousand dollars, to hundreds of millions (if not billions) of dollars. This graph shows the data we analyzed – typically businesses in the $100,000 to $10 million valuation range. The average has been sitting around 2.2-2.3x earnings for the previous two years, and then jumped to 2.88x in 2017, 3.00x in 2018, 3.07x in 2019, 3.41x in 2020 and 3.49x in 2021.

Average multiple over the last 10 years:

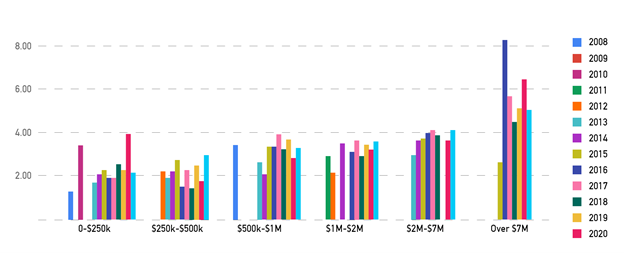

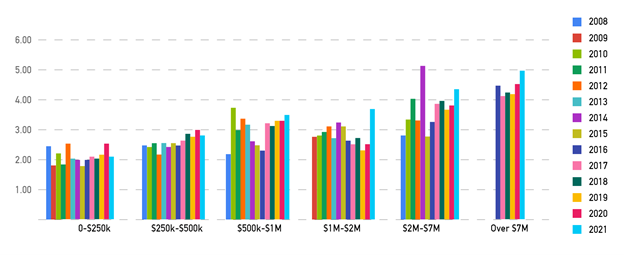

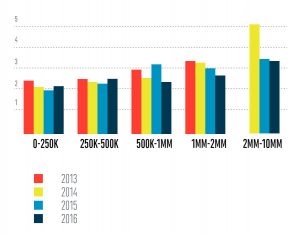

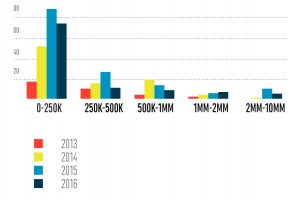

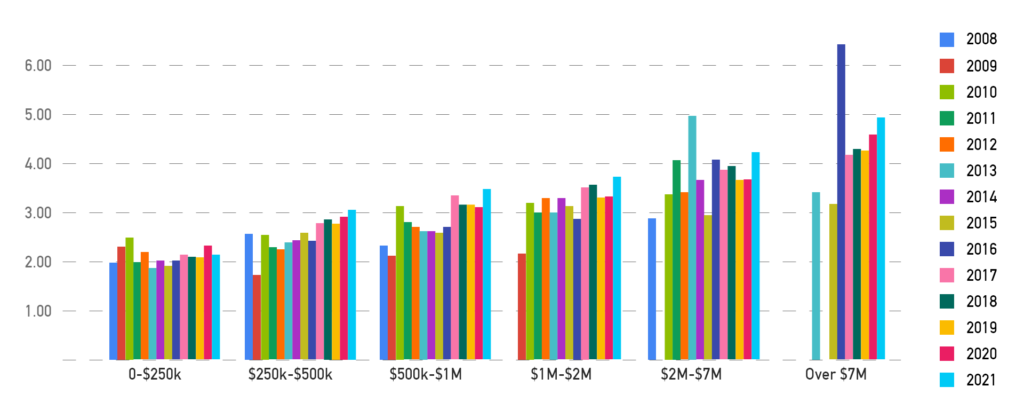

What Size Store is Worth More?

In general, the larger the Ecommerce business, the more it is worth. Here is how to understand this graph below. Let’s say that a business sold for $300,000. On average that would mean that its annual profit was around $111,000 ($300,000 divided by 2.7, because the average multiple for that size is around 2.7x). Another example would be a business that sold for $600,000. On average that would mean that its annual profit was $153,000 ($500,000 divided by 3.26). Similarly, a business that sold for $4 million would mean that its annual profit was around $1 million ($4 million divided by 3.91).

What is the selling process?

The selling process is fairly straight-forward but can be more complex and take more time depending on the size of the business. In general, most sales will be structured like this:

- You decide to sell

- You get a valuation of your business

- You develop a prospectus (all the facts and figures about your business)

- Find potential buyers for your business

- Negotiate a price with potential buyers (total price and terms of the deal)

- Due Diligence – buyer verifies all the financials of the business

- Transfer of the assets & money

- Help train the new buyer to run your business

What is the value of your inventory?

How do you value my inventory?

Inventory is required to run your business. It is customary to include a normal inventory level in the purchase price of a business that can sustain current revenues being generated by the business. Therefore everything over that amount is to be purchased by the buyer in addition to the business valuation. The following will generally happen when considering inventory:

1) Prior to closing the sale, an inventory count is taken and the sale price is adjusted, up or down, from the amount included in the sale price.

2) Inventory is valued at cost. If the inventory is significantly higher than the normal level, a price over that level will may be negotiated.

3) A decision needs to be made whether the cost of the inventory is to be determined by using the original invoice, a percent of retail price, or a professional inventory firm.

4) Not all inventory is created equal. Aged, broken or obsolete inventory will be determined if it is sellable and the price negotiated appropriately. This mainly comes about as discounting a portion of the inventory, but can also be the seller financing a portion and the buyer paying for it only when it sells.

How do I increase the value of my business before selling?

If you can achieve the following you will be able to increase the value of your business:

- Predictable key drivers of new sales

- Stable or growing traffic from diversified sources

- Established suppliers of inventory with backup suppliers in place

- Traffic stats (Google Analytics or other) with a long history

- High percentage of repeat sales

- High percentage of repeat visitors

- Clean legal history

- Brand with no trademark, copyright or legal concerns

- Documented systems and processes

- Growth potential

Where Can You Sell Your Business? The Best Ecommerce Business Brokers

Small Business Marketplaces – (under $300K yearly profit)

Smaller business and micro-businesses are usually best sold privately by the owner through forums or classified websites.

To sell your small business, check out:

Broker – ($300K- $10M in yearly profit)

Medium-sized businesses in the $300k-$10m yearly profit are best sold through brokers who help with finding buyers and negotiating and structuring the deal. To sell your medium-sized business, check out:

- Business Exits – great if your business is making 300k – $10m in yearly profit

Investment Banks and Merger & Acquistion Companies – (over $10M+ in yearly profit)

Larger businesses are best sold through investment banks or merger and acquisition companies. To sell your large business, check out:

- hl.com – best for businesses over $10m in yearly profit

How much will it cost to sell my business?

Generally a business broker will charge 10-12% of the sales price of an Ecommerce business, including inventory (and there can be a smaller, negotiable commission for larger businesses).

How long will it take to sell my business?

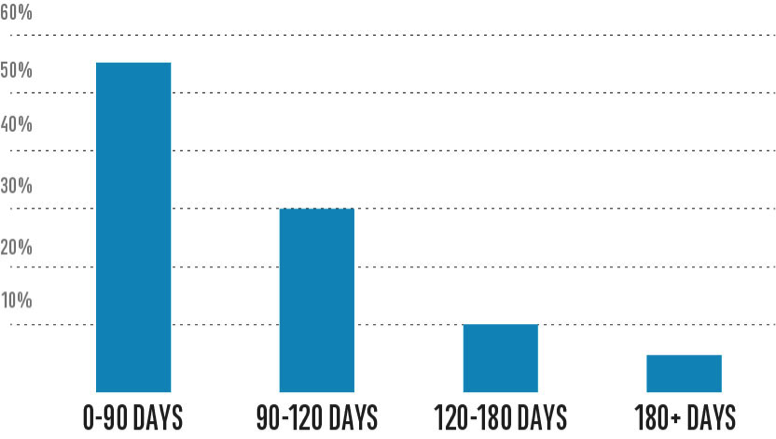

The time it takes to sell an Ecommerce business depends on the individual business and terms of the deal. Generally, larger deals (over $1 million) will take longer to sell than smaller deals (under $300K) because of the complexity of the business and the risk that a buyer is taking. Over 50% of deals close within 90 days and over 70% close within four months.

Kevin Urrutia,

Kevin Urrutia,