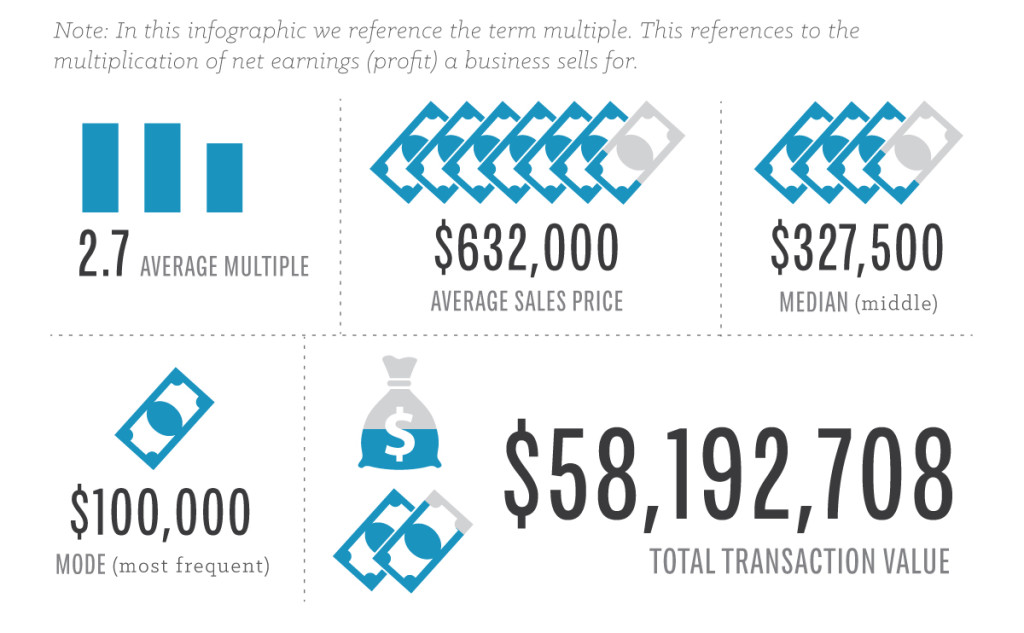

Following up from our successful post last year outlining what online businesses are worth. We have compiled and collated the data for 2013 transactions using the same formula and data source as last year to bring you the 2013 data on what your online business is worth.

Some interesting things were found:

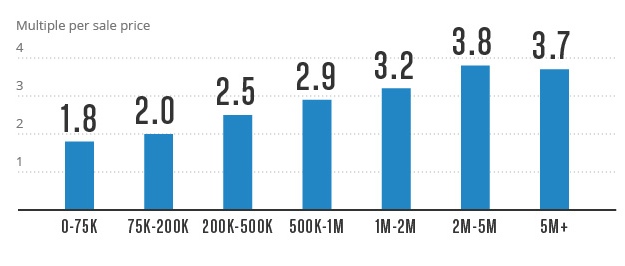

- General sales multiples making online businesses more valuable

- Website valued under $75,000 still sold at an average of 1.8 times net earnings

- Larger businesses ($5 million plus) still commanded the highest multiple

- Average overall sales multiple increased 11%

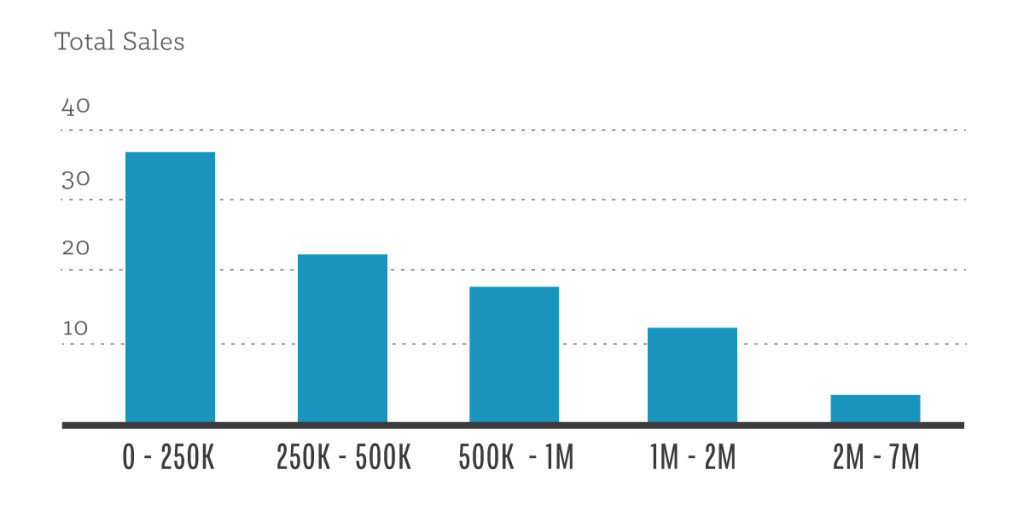

- The majority of transactions are still under $250,000 in valuation

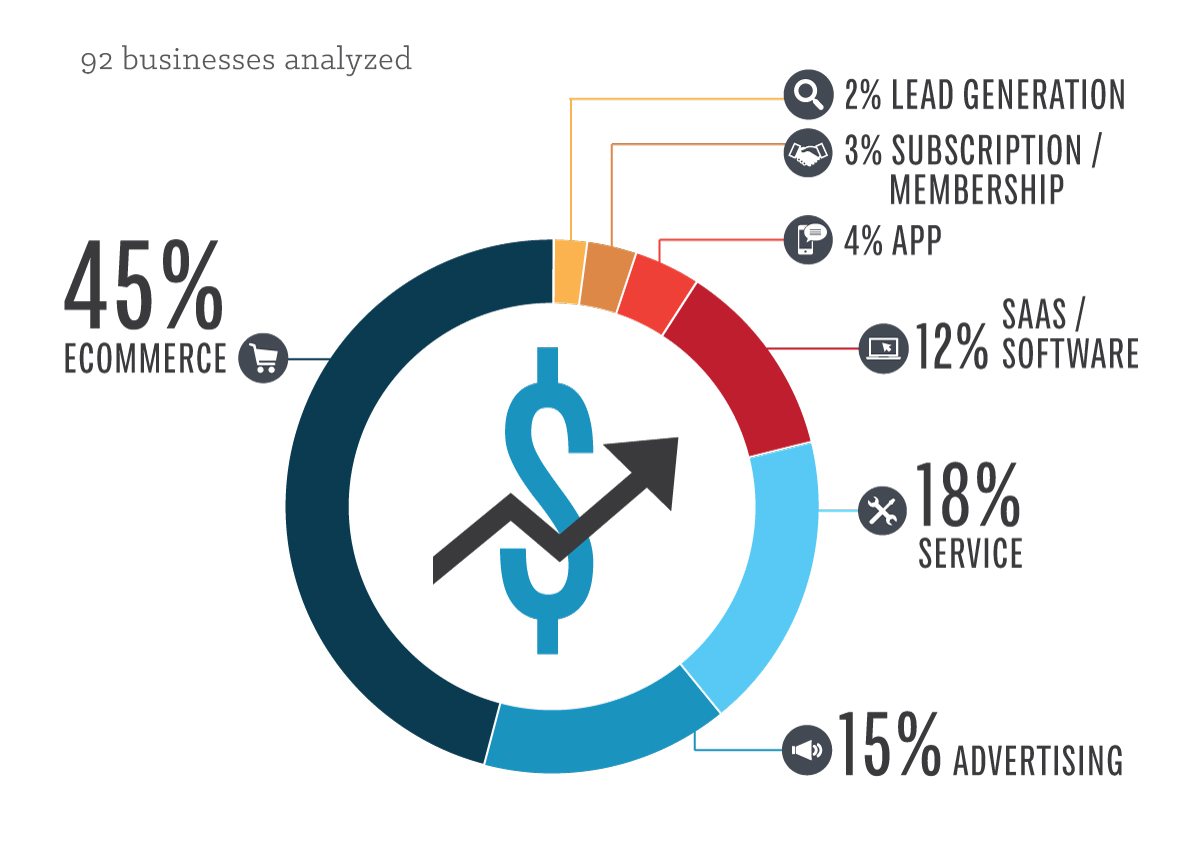

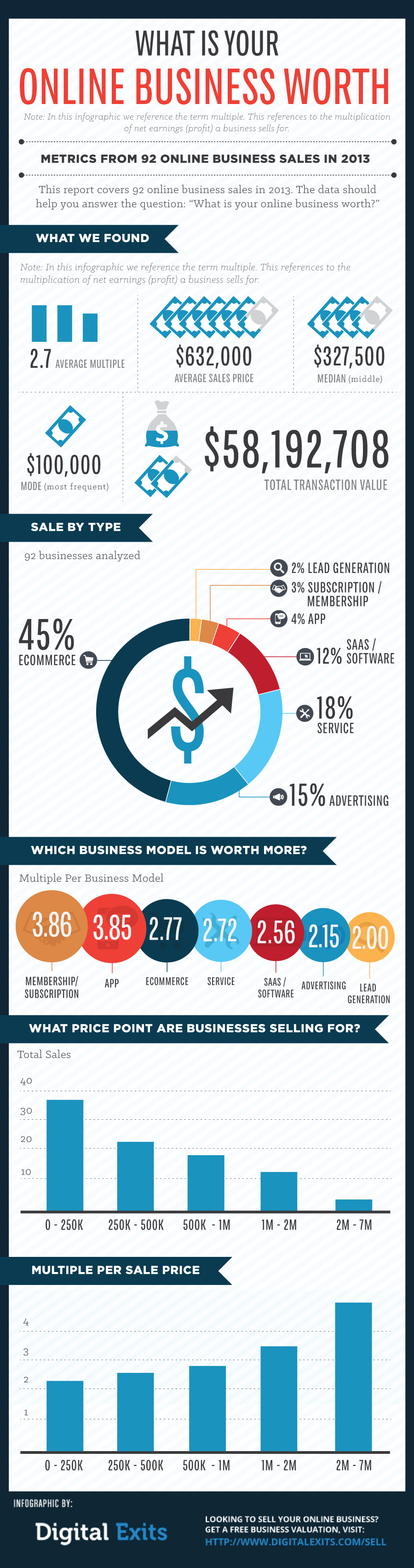

We Analyzed 92 Businesses From 7 Business Models

In total we analysed 92 businesses that were sold between January and December 2013. Again we only analyzed businesses with a sale price higher than $50,000 and removed any outliers in the data set. We changed up the categorisation of business models slightly this year and came up with the following 7 models:

- Advertising – monetized through ads or affiliate offers

- App – a mobile app, monetized through paid downloads, membership or advertising

- Ecommerce – traditional ecommerce stores, drop-shipping and digital products

- Lead Generation – monetized through selling leads

- Service – monetized through providing a service

- Software/SAAS – any other application based business

- Subscription/Membership – exclusive membership only websites (includes directories)

What We Found From Our Analysis

What Was The Selling Price Range?

What’s Is The Average Multiple Per Business Model?

This year we added another business model, membership and subscription, to the data set. Some interesting changes to the data this year is the increase in valuations for service based businesses from 2.0 times earnings to 2.72 times earnings and the decrease in valuation of advertising based sites from 2.6 times earnings to 2.15 times earnings. This is because advertising based sites are relying more on search traffic. Again the same factors as last year determined the valuation of the business:

- Workload – time to manage the business each week. The less workload and more systemised, the higher the value

- Profitability – generally a business with more moving parts (operational expenses) has more expenses

- USP – how easily the business model could be copied or replicated. Easy replication resulted in a lower price

- Age – Older businesses are generally more established and pose less risk, therefore demand a higher price

- Risk – buyers thought certain models posed more risk than others. For example a service based business is seen as higher risk because of the higher client churn rate, reliance on service delivery of staff and low barrier to entry

Are Smaller Or Larger Businesses Worth More?

What I got wrong

- Dropship going to die out – There has been an increase in the multiples being paid for drop-ship websites. The supply of dropship sites has been steady. Buyers are still enjoying the passive nature and ease of operations that comes from running a dropship website.

- Small websites become more valuable – Again this data alludes me. There is a massive amount of demand for sites that are valued below $100,000, the most demand in fact. Yet for the second year running the average multiple sat at 1.8X net earnings.

- Investment firms starting to increase investment – There hasn’t been a large influx of corporate capital into the buying websites space. Based on this years results I still think we are a few years away from the large capital markets

What’s in store for 2015 ?

- Valuations Increasing – Again simple economics states that the more demand there is for a product the higher the price will be.

- Traditional financing becomes an option – Lately I have been having several conversations with financiers who lend on small businesses and they are starting to be open to the conversation about lending on online businesses. While I have yet to meet anyone that has lent on an online business yet I can see a deal or two happening this year.

What Questions Do You Have ?

I want to hear about how YOU plan on using this data when selling your business or any questions you have. Don’t be shy: drop a comment below right now and share the love!

Here is a link to the infograhic: Click here