What Is My Business Worth?

- How To Value An Online Business

- Seller’s Discretionary Income: What is It and Why Does It Matter?

Getting Ready For Sale

- How to Improve The Value Of Your Web Business

- Accounting: Cash Basis Accounting vs. Accrual Basis

How Does The Process Work?

- What Is The Process

- WhatTypes Of Offers Will Your Review

What Happens When I Get An Offer?

- Due Diligence

- Deal Funding

- What Legal Contracts Do I Need?

- How Do I Get Paid?

After The Deal Closes

- Transferring the business

- Re-sell or hold?

When you are selling your website here is what you need to know. What your about to read is a summary of the process that we use to filter, value, prepare and sell websites. We offer an internet business broker service if you are looking to sell.

Warning: this post is currently 4500 words long so you might want to bookmark it and come back to it later. If you only want to read one post on this website make it this one. I plan to make this the Ultimate sell your website resource on the internet and will be continually updating it with the most recent information.

Is My Website Fit For Sale?

The first question you need to be asking yourself before venturing down the selling path is “is my website actually fit for sale?”. What I mean is do you have a profit producing asset that is of value to potential investors. If it fits into any of these categories then you have a winner:

- #Profit producing website

- #Most likely older than 1 year

- #That makes at least $3,000 per month net profit

- #That has consistent earnings

- #That has stable traffic

- #That has some type of systems in place

Why You Can’t Sell Potential?

Ideas are cheap. Every man and his dog has an amazing idea for something. It is only the people that get moving on those ideas and turn them into a profitable business that prosper. Key term there profitable. Most seasoned buyers, the first thing they will ask is “How much does it make and what is the net profit”. Notice how that question wasn’t whats the potential in the market. Buyers are ruthless, logical and calculating that love crunching numbers and beating you down on price. So wipe that word from your vocabulary, no-one is sitting around looking to pay for your unproven ideas, or pay for your poor development or crappy sales strategy. Buyers pay a multiple of net profit.

As a generalisation, most sites sell for a multiple of 1-3x net earnings. Or 1 years net profit to 3 years net profit. Example: on a site that makes 100k net profit per year, that is a sales value of 100k-300k depending on the site and the type of buyer. You may be sitting there thinking, but instagram just sold for $1 billion dollars and it wasn’t making an money. ***Reality Check*** if you are reading this article, then you are no instagram and you probably never will be. I’m referring to private market sales of small to medium businesses that are normally sold to businesses, entrepreneurs or investors.

Each Part Of Your Website Doesn’t Give Extra Value

I get asked all the time, why isn’t there extra value for my domain, traffic and email list?

The simple answer is no there is no extra value. The sum of all your assets does not add up to total value.

Value is derived from the profit that those assets generate.

WRONG VALUATION:

A site makes $20,000 per month. It has a great brandable domain, massive traffic, large subscriber list and good web design.

You think it is valued like this:

Site making $20,000 per month X 2.5 years earnings = $500,000

Domain = $20,000 (it cost me this much)

Traffic = $50,000 (because I should get extra value for my traffic)

Subscriber list = $50,000 (because I can email my list any time and make money)

Web Design = $10,000 (because that is what it cost me for this site)

Total Value: $630,000

RIGHT VALUATION

Site making $20,000 per month X 2.5 years earnings = $500,000

Why Now Is The Right Time To Sell

A good website can make a lot of money. But a good website will also make you a lot more money in the future. So why sell?

When the Opportunity Cost is Higher not selling

With limited resources such as time, energy, talent, people, capital. If they are better invested in other ways then it may be time to sell . The opportunity cost of being involved in your current Company/Business might include giving up:

- #Another business venture or opportunity

- #Time for rejuvenation and reflection

- #Friends, family, and grandchildren

- #Diversification of investments or reduced risk

- #New challenges, intellectual stimulation, or education

- #Health, travel, community involvement, spiritual service

- #Or, any other opportunity that can not be pursued because of the demands of your current Company.

If the need is greater for any of the above then it might be the right time to sell.

You receive a highly inflated offer:

You know the market. If you receive an offer that is well above the market and well above the value it may have in 5-10 years time, get out now. Pigs get fat, hogs get slaughtered.

The Business In Risky

If there is a high risk level of the business, whether that be a heavy reliance on one traffic source or income source. Or in a volatile market like gambling or credit cards that can change dependant on government legislation or market forces. You could suffer a huge blow at any time, maybe it is the right time to take your money and run.

You need the money / Your sick of it

Sometimes you just need the money, it happens. Or you have just lost your passion and are burnt out. Whatever the reason the pain can be alleviated in the short term, but it might not be the best in the long run. Thus solving your problem today, you have to give up potential in the future. An option might be to to partner with someone or sell some equity.

You can get better returns elsewhere

In my opinion a website should be seen as an investment. Generally you can achieve the below returns from there respective investment channels . These rates obviously can vary dramatically depending on the market, your skill and knowledge of these sectors.![]()

- Cash – 4%

- Bonds – 5%

- Real Estate – 6%

- Stocks – 10%

- Small/Medium Business – 33%

If you can make more money elsewhere, then jump ship, or if you are underutilizing the current site, and you think someone else can do better, then it might be time to move on.

Market Is at It’s peak.

If you think your site has hit it’s full potential then it may time to offload the site.

Why Now Is The Wrong Time To Sell

Selling your business and having a million dollars in the bank is plain stupid unless you have a plan for it. If you don’t have an asset that is appreciating at the same or greater rate than the asset you are selling (where an asset is defined as something that makes you money, could be property, a business etc.) then it may not be the right time to sell.

Selling in a bad financial position

You are going to get a significantly lower multiple for your business if you have had a bad financial record in the last year or two in comparison to historical data. If possible, holding onto the business and improving the financial position of the business will get you a larger sale price. Or, if you need the cash quickly, to pay an impending bill, deadline. Ask yourself are there other avenues to take that might be a possibility. For example, selling a percentage of equity or asking for an extension on the impending deadline. You will be cutting yourself short if you don’t explore all avenues.

Selling to pay off manageable debt

Let’s say you have $25,000 in bad debt from college. You are thinking of selling your website for $100,000 to pay of that debt and put some cash in the bank. The payments on that debt are $300 a month. So the current site can maintain that debt can probably. It may be an idea to take that $25,000 and over the next year and invest that money into your $100,000 website and after 12 months it is now worth $200,000. Think about the opportunity cost of that money and take that into consideration when selling.

What Is My Website Worth?

What your website is worth is purely determined on, not by what you’d like to get, but what buyers are likely to pay. Therefore the pure definition of what is my website worth is: What someone is willing to pay for it. That is purely determined by how quickly can a buyer get their money back.

If a potential buyer sees no way to make their money back they are not going to purchase the site. People will then go onto say your website is worth a multiple of earnings. 12-36 months earnings get’s adopted for web businesses. So what determines that number? To get a better understanding of that we first need to determine what real value is:

What Is Value?

Value in its purest form, by definition is “the monetary worth of something” So what determines the monetary value of a website, quite simply this: There is a return on investment to be made by the buyer. If the potential buyer can’t see a way to make his money back and then some, he’s probably not going to buy and thus your website has no value (monetary worth).

Just because you invested $30,000 into development of your website doesn’t mean it automatically has $30,000 in value if that website isn’t producing income.

What Level Of ROI Is Required

To understand why buyers will pay more for some things and less for others we need to look at return on investment (ROI). If a buyer pays a 1x multiple, they will likely get their money back in 1 year. 2 x multiple, money back in two years. 3x multiple, money back in 3 years. However if we look at these as percentages you will start to see a trend arising here as to why other asset classes (stocks, bonds, real estate etc.) get valued the way they do.

If you were to pay a 2x multiple your would be receiving a 50% ROI. That is you would get your money back in 2 years. Generally small to medium business multiples are 2-3 times earnings because it is a 33%-50% return on investment. Small business are classified as a riskier asset class than lets say residential property, which normally sits in the 4-5% ROI (20-30) year return because it is deemed a safer investment with a more secure future revenue stream.

Risk and Value

So the amount a buyer is willing to pay will be based on the level of risk they are willing to take. The higher the risk the lower the price.

What Website Buyers Will Pay More Money For

These factors below lower the risk of losing future earnings and thus increase the price you are likely to receive for your website

- #Solid earnings

- #Positive growth trend

- #Processes automated

- #Defensible Market (a site on CD’s has little value today)

- #Room for growth

- #Strong brand

- #Diversification (of revenue and traffic)

- #USP (some type of unique asset)

- #Key assets (like email list, premium domain, supplier contracts etc.)

- #Legal Liabilities (you have none)

Valuation Methods

Buyers will usually utilize one of the following valuation methods when approaching your site.

- Asset Valuation – buyers may make their valuation based on the assets of the website. Be it traffic or customers, buyers will look at ways of leveraging those assets to get a quicker return on investment

- Future maintainable earnings – buyers might look at the rate of return they can expect from the website by capitalizing future earnings. This is achieved by multiplying the average profit by the desired rate of return.

- Earnings multiple – buyers may apply an earnings multiple to your website example net profit multiplied by 1.5X

- Comparable sales – buyers may search for similar sales of you website to find comparable sales data.

How A Buyer Will Deconstruct Your Business

The following is a analysis of what buyers will look at when analyzing your business. These factors will determine the offer they are likely to make.

- Business Model – certain business models are riskier or more labor intensive than others. Buyers will value your model differently based on their perceived risk and understanding of the business.

- Current Year Earnings – how much your website made in the last 12 months is the main basis of the valuation.

- Current Yearly Profits (made up of assets and liabilities) – do the business process and systems affect its profitability? Can we decrease costs somewhere or develop a synergy? These are the things buyers will be asking themselves.

- What is my traffic and where does it come from – buyers will see a high reliance on search engine traffic as risky. Conversely if traffic sources are spread well from multiple sources then there is less risk.

- What is the growth trends – which way is the business trending? A growth trend will attract higher prices.

- What is the market like – a website in the CD market is going to be worth a lot less than a website about golf. Consistent industries will receive higher earnings.

- Where can value be added? – potential buyers will ask themselves where they can add value to the website to get their money back quicker.

What If It Has Been Effected By Google Updates ?

If your site has been hit and lost a large proportion of your traffic then unfortunately it is worth little/or nothing if it was previously profitable. If consistent earnings can be proven the site may regain some of it’s previous value.

8 Ways To Prepare Your Website For Sale

Below is the top 8 things your must do to

- Don’t change anything – buyers are wary of any recent changes and will wan’t to know why things were changed. This includes site redesign, change of monetization methods, new server, domain change or any other changes.

- Organize your statistics -get your traffic statics for the last year. Create an excel spreadsheet of your profit and loss statement for your website since it’s inception.

- Fix up any website errors -do a quick check for any errors in your web code and clean them up

- Check your legalities – don’t let anything come back and bit you later.

- Establish a selling price – based off the advice from this article figure out how much you think a potential buy might pay for your website then add a small margin on top of that as a starting asking price.

- Create your Information Memorandum – develop your selling document outlining.

- Identify anyone you think might be interested in buying your website

- Create time – you’ll need some time to talk to buyers. They will ask lots of questions about your website. You might feel that some things they are asking are irrelevant, however bite your ego and present everything in a polite and respectful way. At the end of the day you never know who will cough up the money for your website so don’t burn your bridges.

The Process To Sell Your Website

This is the Digital Exits process that we go through with our clients helping them sell their business:

Step 1 – Get a valuation

The first step you will want to know is what your website is worth. We walk our clients through the valuation process after analyzing the following:

- Historical and current profit and loss statements

- Historical and current balance sheet

- Traffic stats of the business

- After spending considerable time getting to understand the business, the industry, the competitors and the general market conditions

Step 2 – Getting all your documentation together

Once you understand what your business is worth it is time to get together all the documents and proof that you will need to show a buyer when selling your business. Sellers are going to want to see numbers and facts when considering the purchase of your ecommerce business. You’ll need to have as much data, stats and proof as possible. If any of the data comes back suspicious or incorrect, buyers can use this to lower their asking price or pull out from the deal altogether.

Here are the key things that we prepare for a buyer:

General Information – Includes quick data points that answer frequently asked questions buyers want to know up front. Including:

- Summary of facts – the most important information you want the buyer to know about your business including sales, profit, traffic, staff and a general FAQ.

- Summary of operations – AN overview of how the business works. How many employees do you have? Salaries paid, processes setup for automation, hours of week needed to run the business and any other information that you feel is important.

- Summary of customer sources – Who are the clients and how do you acquire them?

- Summary of products and processes – What do you sell? How do you sell it? How many products do you have? What are their stats and margins? How are the suppliers and what is your relationship with them?

- Summary of security – How do you protect your digital property? Patents, copyrights, trademarks? What security processes do you use to keep bad people from stealing or destroying your digital business?

Marketing Information – This summarizes how you get new customers:

- Summary of marketing – How do you get new customers? Do you have media mentions, awards, or publicity? Any information that can help new buyers understand your business reputation.

- Traffic stats of the business – What are your keywords driving traffic and where do you rank on search engines for those keywords? What other traffic sources are driving both visitors and sales to your business?

- Marketing Strategies – Specifically, what processes do you have in place to reach new customers and how do you implement them? Is it automated? Do you have employees with this specific job (in-house or virtual assistants), any joint-ventures setup with media outlets or other businesses that help drive traffic?

- Customer Demographics – Do you have a customer profile setup that includes age, gender, location, income level, needs, etc? Do you have visitor statistics that reflect those demographics?

- Competitor Landscape – Who are your competitors? What are they doing different? Do you have a barrier to entry that prevents competitors from taking market share? What makes your site unique compared to them?

- Sales History – How many products have you sold over a period of time and what are their margins and conversion rates?

Formal & Legal Information – You’ll need to provide proof that you own the site, have rights to do business, and proof of the revenue that the business is making. With regards to revenue documentation makes sure you include:

- A break down on your ROI

- Any appraisals you have received from other parties

- And any contact information regarding the sale of your business

- Bank statements

- Merchant facility statements

- Historical and current profit and loss statements

- Historical and current balance sheet

Step 3 – Develop a prospectus or “the book”

A prospectus or information memorandum is a detailed 10-30 page documents that outlines:

- What the business does

- How the business makes money

- Where the web traffic comes from

- How the business operates

- General frequently asked questions about the business

- Market Trends

- Growth Opportunities

This document is then used to present to prospective buyers to highlight the business opportunity.

Step 4 – Finding a buyer

You can use the following channels to look for a buyer.

- Personal Network – Your existing network of business owners, friends and family.

- Brokers network – A broker usually has an existing buyer network of pre-qualified investors looking to acquire an online business. Digital Exits has over 1,000 + people on their buyer database. Of those 55% elected that they were interested in acquiring an ecommerce business.

- Competitors or Vendors –A competitor is going to look to control market share and a vendor to vertically integrate and control retail through acquiring your business.

- Classifieds, Auction Sites, and Forums – This is a place where buyers are hanging out and are good sources to find potential buyers. Sites like bizquest.com and businessforsale.com.

Step 5 – Getting an Offer

The process of receiving an offer from a buyer is generally split up into two steps:

- General FAQ

- Letter of intent

General FAQ

Once a buyer receives the prospectus there will generally be some back and forth between the buyer and seller about the business. This will be clarification on the business; it’s operation and questions about information in the prospectus. Generally there will be email back and forth, a few calls between buyer and seller before an offer is made.

The Letter Of Intent

A letter of intent (LOI) is a formal offer that a business owner will make to acquire your business. This LOI will include an offer price and terms. Once you accept this LOI you allow the buyer to move forward, exclusively, into a deeper due diligence period where they will address all the claims you made about the business and verify that what you claim is correct. A LOI is a non-binding sales agreement. This is not a contract for sale.

As a seller the following needs to be considered before accepting an LOI:

- The buyer – have you done your background research on them? Criminal record check? Bankruptcy check? Do you like them? Do they seem legitimate? Your broker will help you with some of these steps however remember that you will likely be dealing with this person a lot in the future.

- Deal terms – What sellers forget to realize is that it is the deal terms that are more important than the actual offer made. Things to take into account are the percentage of upfront cash, the financing or performance terms and if there are any conditions attached to the deal.

- Owner financing terms – things to consider are the length, repayment terms and if there is any interest attached to the deal.

- Non-compete terms – what are the restrictions on the non-compete and what is the time length of those restrictions (2-3 years is generally considered)

- Exclusivity – in the LOI there will be a time frame for how long the exclusivity period is that they want to engage in due diligence. Generally on smaller less complex deal 1-3 weeks is acceptable, more for a larger deal. Consider how long your business will be locked up in due diligence while the buyer verifies everything and isn’t allowing you to talk with other buyers.

- Timeframe of closing – sometimes the highest offer is not always the best offer. If you are waiting 3 months for a loan to be approved versus cash deal tomorrow. Consider the time it will take to get the cash into your bank account.

- After sale support – an inexperienced buyer is going to take a lot more hand holding after the sale than a seasoned investor. Consider the amount of time and investment you will have in the deal after the sale when assessing the LOI.

Step 6 – Due Diligence

After a letter of intent has been agreed upon and signed, the due diligence phase of a deal commences. Due diligence is the exclusive period (where you can’t offer the deal to any other buyers) that a buyer gets to verify that all the claims that you made about the business are correct. For example if you said you made $1.2 million dollars in sales in the last 12 months a buyer is going to want to see that you did in fact make $1.2m in sales by checking merchant account statements and bank statements.

NOTE: At any time during due diligence the value or original offer that a buyer makes can be reduced if the buyer notices any problems with the business. For example a buyer might find that there is a potential problem with a key supplier or that some of the inventory was slow moving and that would get devalued. A buyer must factor in a lower price to adjust for that risk if they find any problems.

Here is a list of some things that a buyer might request during due diligence:

- Bank statements

- Merchant statements

- Paypal account statements

- Credit card processing statements

- Customer list

- Source code

- Suppliers names and information

- A staff list

- Interview with staff

- Interview with sub contractors

- Contracts for suppliers

- Contracts for staff

- Current and historical Tax returns

- Current and historical Balance sheet

- Interview with customers

- Support desk overview

- Business systems and processes

There are some key differences between the due diligence of a brick and mortar company compared to an online business:

- Financials – A lot of verification of financials performed with an online business is a reconciliation of bank statements. It is expected in brick and mortar deals that tax returns or audited books will be required. This will include things like bank statements, invoices, credit card statements etc. A lot of deals there is a live screen-share/walk-through of the bank of a business to assist with verification

- Traffic – whilst a traditional business has customers walk in the door an Internet business has eyeballs to a website. Having Google analytics installed (the accepted tool) to report on traffic statistics will go a long way to getting your deal closed.

Step 7 – Final Offer & Legal

After due diligence is completed a buyer will either make their final formal offer or pass on the deal because it didn’t pass due diligence. If it did pass we as the broker prepare a standard contract for sale which will outline the deal terms, the assets being sold, the non compete and training and support terms.

Note: in most deals you will be selling the assets of your company not the company itself. What this means is that say Internet LLC owns www.internet.com. In the deal Buyer LLC pays Internet LLC for the assets of the business (the domain, the website, the customer list, the merchant accounts, email list etc.) they do not buy the shares in the company. This is called an asset sale versus a share sale.

As a disclaimer we are not lawyers and you should always have your legal counsel independently review the contract before signing.

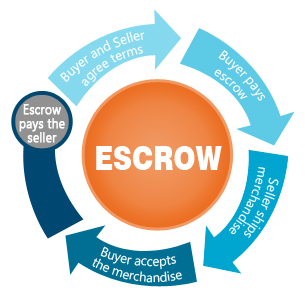

Step 8 – Transfer & Escrow

After all parties have agreed and signed the asset sale contract the transfer process commences. This process is broken up into a few stages:

- Sales contract signed

- Broker sets up the escrow transaction using either

- Escrow transaction terms agreed by Buyer and Seller

- The buyer sends the escrow the agreed funds (funds are secured but not released)

- The escrow service confirms receipt of the funds and requests the seller to start transferring all the assets to the buyer

- The buyer confirms that they have received all the assets according to the terms of the agreement and initiates the inspection period

- Inspection period is used to confirm all assets have been received and are in working order

- Buyer confirms satisfaction with assets receive and notifies Escrow service

- The escrow service releases the funds to the seller

- Training beings for the buyer

At no point during the process are the buyers funds released to the seller without the buyers consent. This allows for an at arms length transaction.

Step 9 – After Sale Training & Support

Generally there is a typical 4-16 week period of support for the buyer after the deal has closed. This is put in place to assist the buyer in learning the day to day running and operations of the business. The length of time and training that a seller provides is purely contingent on what was negotiated in the terms of the deal.

Should I Use A Website Broker?

What does a website broker do?

A website broker helps you sell your website by getting it ready for sale, showing it to potential buyers, negotiating offers and then finalizing payment and handover.

Why Hire A Website Broker ?

There are generally four main reasons why people hire a website broker. Marketing, Price, time and confidentiality. By hiring a broker you get access to their network of qualified cashed up buyers (marketing), they can apply the appropriate valuation methodology to your business to come up with the highest asking price possible (price) saving you time bringing their knowledge and experience to the table (time) all while showing your business to select qualified buyers so you don’t have to advertise to the world that you are selling your website.

What does it cost ?

Brokers charge a standard rate of 10% commission. 15% for smaller sites and negotiable rate for sites worth over $1,000,000. They only get paid when you get paid, and the more you make, the more they make so rest assured they will be working hard to get your site sold for the top price possible.

Do they charge fees upfront ?

No. Brokers work on 100% commission basis. If you don’t get paid, they don’t get paid.

How Long Does It Take?

It normally takes about two weeks to four months to finalize a website transaction. However some sites can take a week and some sites a year—it really depends on the site in question. The longest part of the sales process is normally the due diligence and the back-and-forth between buyer, seller, and broker. Some buyers need more time than others. If buyers request things like tax returns or older financials, it usually takes a little while longer.

What happens if they can’t sell my website?

A typical exclusive agency agreement lasts around 60-90 days.

Where To Find Buyers

Below is a list of where you may locate a buyer for your website.

Website Brokers: Brokers attract buyers due to the volume of listings that they have. There is usually no upfront fee, however a percentage of the successful sale is taken for the service rendered.

Classified Sites- are mainly aimed at selling traditional brick and mortar businesses. They will charge you a listing fee ($100-$250) to place an ad on their website for a certain time period.

businessesforsale.com

bizquest.com

bizbuysell.com

Marketplace Sites

Digitalpoint.com

flippa.com

websiteproperties.com

ebay.com

craigslist.com

websitebroker.com

daltonsbusiness.com

business-sale.com

Larger Buyers (normally in the millions)

internetbrands.com

verticalscope.com

crowdgather.com

namemedia.com

escalatemedia.com

ezoic.com

advameg.com

untd.com

oneclickventures.com

wmmediacorp.com

invenda.com

domainnewmedia.com

AlphaBrandMedia.com

mediawhiz.com

nicheplayer.com

webuywebsites.org

Forums

Experienced-people.net

forums.digitalpoint.com

webhostingtalk.com

webmaster-talk.com

dnforum.com

Private Sale – Private sales usually occur when webmasters find a strategic buyer (competitors/suppliers/customers) in the similar market who will benefit from from the acquisition than a financial buyer. The advantages for a strategic buyer would be cost savings or customer cross promotion.

Different Types of Buyers

First Timers – It is said 70% of businesses are purchased by people coming out of corporate jobs.

Financial Buyers – These buyers are just looking for a return on investment and will value your business in a way to get their money back as quickly as possible.

Strategic Buyers – Usually consisting of competitors, suppliers, customers or complimentary businesses.

Investors – These buyers purchase websites for their portfolio and usually buy hands of automated businesses where their is little day to day management of the website.

Negotiation Tips

Good negotiation starts with good preparation. Those that fail to prepare, prepare to fail. In the case of selling your website preparation comes in the form of organising all your information to present to prospective buyers in a clear and concise manner.

Note: These tips only come from experience.

- Be in a strong negotiating position (basic fundamental have a good website that lots of people will want)

- He who wants it less wins in negotiation

- Figure out the minimum you want for you website and then add a margin on top of that for negotiation (be aggressive)

- Don’t take things personally

- Understand the power of anchoring

- Read Harvards negotiation tips

What Will They Offer (Types of Financing)

All too often negotiations get sidetracked with emotional sellers high valuation and shrewd buyers low valuation. This is a lot easier to control if you enter into a pure cash sale, however it can be a struggle if the sale involves a level of seller financing, work-out or future earnings agreement. As a buyer you need to determine what is more valuable,time, risk or money. A cash sale will have smooth negotiations if the earnings multiple is agreed upon. As a note Independent advice can mostly sway a valuation. It is in the interest off all negotiations to be quick and painless. It is thus a good idea to set.

That being said if you are not offered a pure cash sale to settle on your website the other option that sellers will present in most smaller website deals is some type of seller financing.

Seller financing is a loan provided by the seller of a website to the purchaser.

There are three types of seller financing:

- Straight Financing – Like taking out a loan from the bank except the the person lending the money is the website owner

- Performance Based – making payments based on the future performance of the website

- Holdbacks – a small amount of money (usually 10% of total sale price) that is help back and paid at a later date (usually 30-60 days)

Seller Financing Example

Example 1- A website is sold for $200,000. $150,000 is paid upfront in cash and the remaining $50,000 is paid off over 12 months at 10% interest. So in the end the seller gets $205,000 for their website.

Performance Based Examples

Example 1 – A website is sold for $200,000. If after a 12 month period the websites monthly income has been more than $18,000 for the past three months running, a bonus payment of $40,000 is to be paid.

Example 2 – A website is purchased for $200,000 and the seller is entitled to 8% of gross profits for the website over the next twelve months.

Holdback Examples

Example 1 – A website is sold for $200,000. $180,000 is paid upfront and $20,000 is paid after 30 days once the website seller has provided training to the new owner.

How Do You Tranfer The Money?

If you have a deal completed and it is time to handover your assets you probably don’t want to run the risk of transferring your domain name without getting paid first. And the buyer doesn’t want to transfer his money without getting the domain. Kind of like the chicken or the egg theory.

The Solution?

Enter third party escrow services. An escrow service is a company that acts as a middle man for a transaction. You emply the services of an escrow service. The buyer transfers the money to the third party

Who Provides Escrow Services.

Generally a lawyer or realtor provides an escrow service when transferring a house. When selling your website you may want to engage the service of a lawyer to act as an escrow service. They normally charge anywhere from $500 to a few thousand dollars.

Alternatively you can use an online escrow service

An online escrow service is just like using a lawyer, except the system is more automated. This doesn’t mean it’s safer, it just means they can use economies of scale and reduced costs equaling lower transaction fees for buyers and sellers.

options include:

How much do they cost ?

We use escrow.com for all our transactions. This doesn’t mean other options aren’t good, we have just had experience with them. Note: we are in no way affiliated with them and do not make any commissions from recommending their services.

How much do they cost ?

Check out escrow.com fee calculator here:

How the process works ?

Resources:

Website Buying And Selling Forum

Shane Sold His Website For $1,000,000

Slideshare.net Presentation on valuing website

Yaro’s Sell Your Website 2005 Article