You’ve spent a lot of time, effort and equity into growing your business and have decided it’s time to sell. The objective is to get maximum value and in order to do this, it’s imperative to work with a broker who can follow a process that ensures smooth and organized steps to fulfill the business’ ultimate sales potential and find the right buyer from both a financial and relationship standpoint.

Make selling your business easy with these eight steps.

1. Determine what your business is worth

A business is generally worth a multiple of its’ profit. Depending on the size of the deal and the industry, that can range from 2-10 times the profit. Smaller businesses (under $3M in price) generally average 2-3 times profit, medium-size businesses ($3m to $20m) can bring in 3-5 times the profit and large businesses ($20m and over) will often see 5-10 times the profit.

2. Prepare your financials with your accountant

Because a business is valued on its’ profit, thorough and accurate financials are essential, including preparing an adjusted profit and loss statement to present to buyers.

3. Find a broker or investment banker

Depending on the size of your deal and factors such as industry, revenue and potentially having unsolicited offers on the table, most companies will garner a higher valuation when they work with a banker or broker who can bring strategic insights to the process.

4. Develop the executive summary of your business

This is the document that clearly and concisely summarizes the key points of your business’ operations, mission, management, products or services, competitive advantages and financial data to provide an overview that will help a buyer compose an offer.

5. Put your business on the market

Market your business to strategic buyers seeking to acquire a company similar to yours.

6. Field offers from potential buyers

Receive offers from buyers and negotiate the best one based on your expectations around price and other important factors.

7. Let the buyer perform due diligence

Buyers generally receive 60-120 days to verify a business’ financials and validate that all the information presented is accurate.

8. Close the deal

Time to celebrate! Sign the final contract and begin the handover transition.

FAQs On Selling A Business

How much is my business worth? You can sell your business for what the market will pay and it is the buyer that determines the price of a business. That being said, a business is generally worth a multiple of the earnings, which means a value applied to the profit of your business.

How do you price your business for sale? You price your business for sale depending on how much money it makes. It you are making no money, the price is based on the value of the assets. If it is making a little bit of money, the price is based on a seller’s discretionary earnings. If it is making a lot of money, the price will be a multiple of EBIDTA.

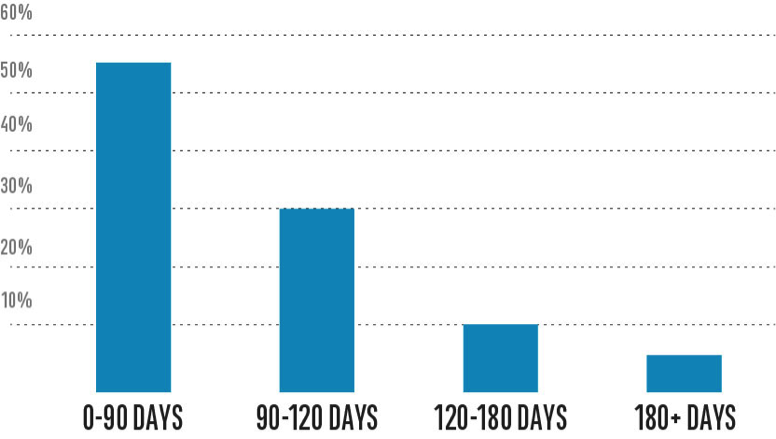

How long does it take for a company to sell? Generally the larger the deal, the longer the time frame it will take to sell a business. At Business Exits, we average about 7 months to close a deal.

How can you sell your business quickly? You can sell your business quickly by having it priced correctly and with the right terms. One of the best ways to sell your business fast is to offer it to someone with no up-front payment and an earnout based on performance. This option can be presented to your business partner, employees, competitors or someone in your network.

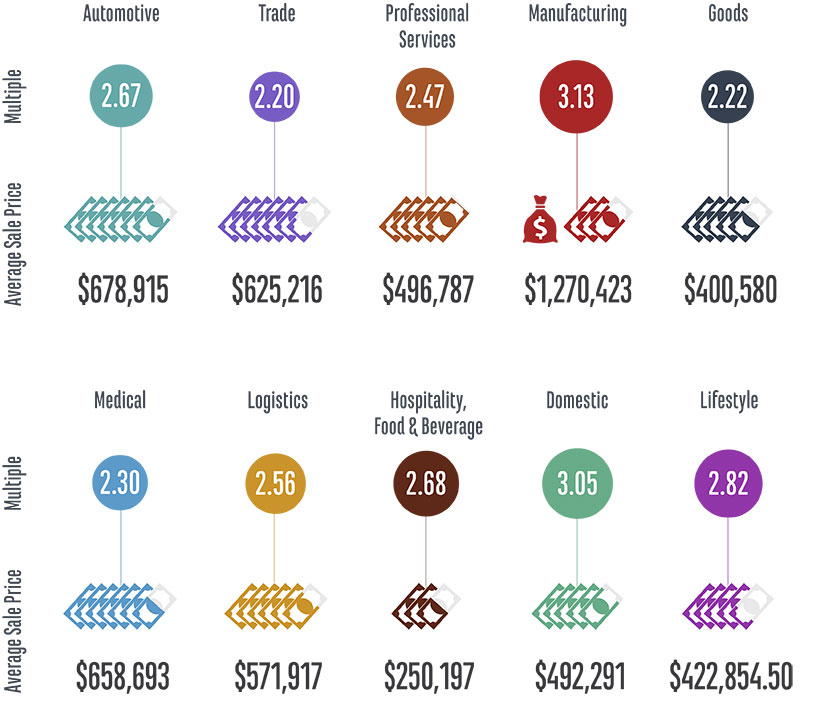

What type of business is the best to sell? Businesses in all industries can be sold. However, the differences come into play when assessing valuation across industries. Some of the most attractive industries currently receiving high valuations are service companies, logistics and transportation, property management, home services and technology.

Who is the best broker to sell my business? This depends on the size of the deal. Small deals (under $1M in revenue) might be best to use a service like bizbuysell.com. For larger companies, try businessexits.com as they specialize in selling companies with $1M to $25M in yearly revenue.

We Analyzed 13,817 Business Sales: Here’s What We Found

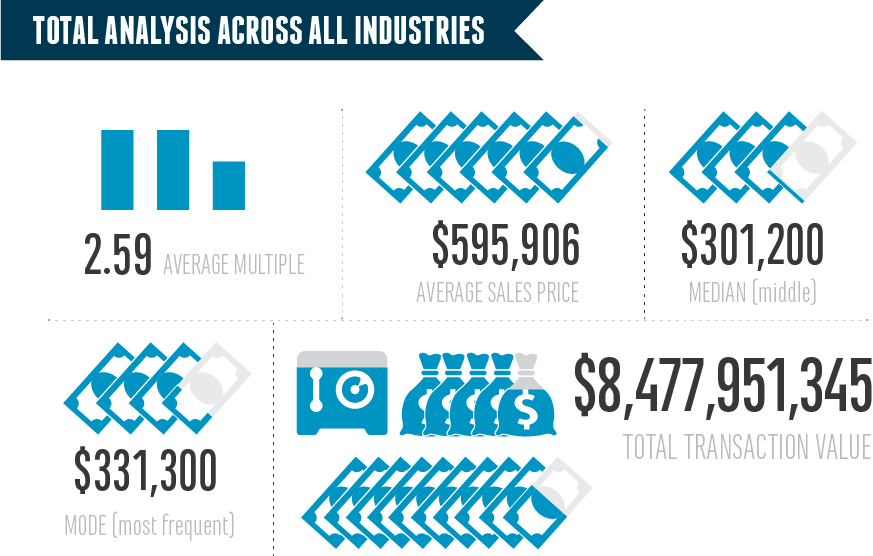

We analyzed the last five years of sales data, including 14,117 transactions between $50K and $100M. As you can see from the graph above, we discovered some key learnings:

- Average multiple of profit sold for 2.59 times profit

- Average sales price was $595,000

- 90% of deals were valued below $5M in sales price

You will see the term “multiple” used frequently. A multiple can be applied to a number of financial metrics in a business (such as EBITDA, net earnings, gross revenue, etc.) to determine how much the business will be worth at sale. We calculate the multiple for a business based on profit using SDE (seller’s discretionary earnings).

Here’s how we determine what the business is worth:

Total Sales – Cost of Goods Sold – Expenses + Owners Wage = TSDE (your profit)

When we state that a business was sold for a multiple of 2.44X, it means that the amount paid for the business is a value of 2.44 times the profit.

For example, a business that is doing $300,000 in profit per year sold at a 2.44X multiple would have a sale price of $732,000 ($300,000*2.44=$732,000). This works in reverse as well — if a business sold for $732,000 at 2.44X, then ($732,000/2.44) means the profit was $300,000.

Here are the types of businesses we’re going to analyze in this article.

What to prepare for selling your business

Potential buyers will be looking for detailed information about your business’ operational and financial health. Here is a list of things you will be expected to have ready with regards to general information:

- -One page fact summary sheet that provides an overview of the business

- -Programs that the website (if applicable) uses and how to work those specific programs

- -Security reports

- -Index of every single webpage

- -Media mentions such as awards or publicity

- -List of employees

Marketing strategy is going to be a big part of the buyer’s decision. You may need to provide information on:

Statistics within Search Engine Rankings – Keyword Research completed and Keywords that have already been Targeted – Visitor Statistics and Demographics – Competitor Information and Research – Sales History and Conversion Rates

The final information you’ll need to prepare is legal documentation, including proof of ownership, transfers and historical or legacy documents such as:

Revenue documentation – Cashflow Analysis – Customer Base Analysis – Intellectual Property – Expense Reports – Profit Reports – ROI Analysis – Appraisals – Prospective Buyers’ Correpondence — Real Estate Holdings Info

3 Best Brokers To Sell Your Business

Selling on your own as a business owner makes sense if you are selling your business to a family member or employee. Selling with a business broker is best if you want to attract multiple buyers and maximize the selling price.

Here are some suggestions for the best business brokers to sell your business:

- bizbuysell.com – Best for small business owners under $300,000 in yearly profit

- businessexits.com – Best for businesses making $300,000 to $10 million in yearly profit (Usually $2m – $100m in revenue)

- hl.com – Best for businesses over $10 million in yearly profit (usually over $100m in revenue)

How long will it take to sell my business?

The average selling process takes to sell a business is 7 months. Simpler deals close in shorter timeframes and more complex deals take longer, ranging from 3-12 months. A business valuation should take a few days and in that process you may decide on an exit strategy to prep your business for sale. Interested buyers will then contact the business brokers for the marketing packet. Prospective business buyers will review tax returns, financial statements and other operational data. Once they are ready to make an offer, they will submit an LOI (“letter of intent”) which may include a down payment. After the LOI, you will negotiate the purchase agreement with your lawyers (and it will usually include a non-compete clause). The process generally takes 3-6 months after the deal closes and the management team transitions.