By Robert Kale and Jock Purtle

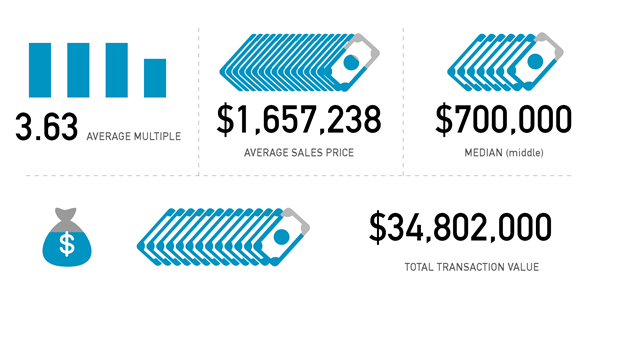

In our 2021 Business Valuation Report, we analyzed the sales of 215 companies for the year 2021 from 7 different categories of business. Over the past few years, software has typically had a higher average multiple when sold, due to its recurring revenue and more attractive business models. Even though 2021 had a high number of high-value listings in the Ecommerce space, software was the #1 category on average multiples, with an average multiple of 3.63x for software business listings.

Here’s a quick summary of which types of business models are worth the most in today’s current market.

According to our data, software companies sold for an average of 3.63x multiple in 2021 – with the highest premium business selling at a 5x multiple. This specific business had $2M in earnings which contributes to the higher sales multiple.

With a valuation multiple like that, getting a great ROI is a no-brainer! With this information, it’s easy to see that investing in the software niche is smart business.

If you’re interested in selling your software company, the real question is: how can you get the best possible rate for your high-value business? And for investors: how can you make sure you’re acquiring a guaranteed winner when you find a great deal?

At Digital Exits, our valuation and vetting processes are second to none. Thanks to our exceptional appraisal resources, buyers know we ONLY offer the highest quality companies and sellers know they’re listing at the best possible price for the current market.

We’ve leveraged those resources to help high-value investors get the information they need to gain an unfair advantage over the competition in the software niche. Here’s what we found:

We analyzed the sale of 187 software companies over the past 7 years to help high-value investors get a competitive edge when buying or selling software businesses in 2022

Here’s what we found:

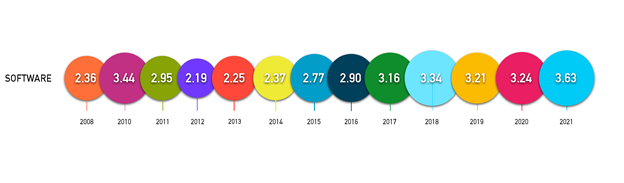

Average Sales Multiples Per Year

If you’re unfamiliar with the term “multiple”, this metric refers to how much a business is worth (also known as the company’s valuation).

The value of a business is calculated by multiplying the amount of profit a business makes, by the valuation multiple:

$ Profit amount x Multiple = Appraised value of the business.

If a Software company generates $350,000 in profit, and is estimated to sell at 3.2x multiple, then the business is predicted to sell for approximately $875,000.

$350,000 x 3.2x = $1,120,000

Here is a quick summary of how much software companies were worth in terms of multiples over the past 6 years:

- Average 2.37x multiple in 2014

- Average 2.77x multiple in 2015

- Average 2.90x multiple in 2016

- Average 3.16x multiple in 2017

- Average 3.34x multiple in 2018

- Average 3.21x multiple in 2019

- Average 3.24x multiple in 2020

- Average 3.63x multiple in 2021

This gives us an average of 3.36x multiple over the past 4 years.

It’s important to recognize that net profit isn’t the only factor in determining value. In fact, valuation is greatly impacted by the size of the business as well. Let’s look closer at whether small or large sized businesses are worth more in this market.

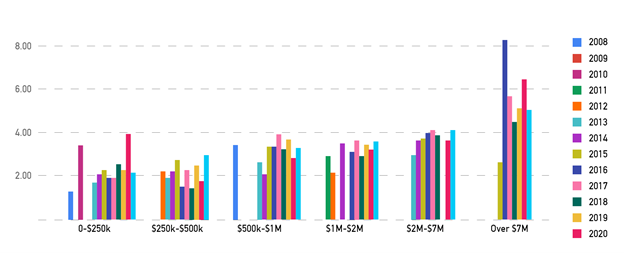

Are Smaller or Larger Software Businesses Worth More?

Now we’ll look at our multiple per sales price. This indicates how the size of a business impacts its valuation multiple. We can use this metric to determine whether large software companies or smaller software companies are worth more overall, by analyzing what kind of multiples they are commanding based on their profit size.

Here’s how business size impacted the valuation multiple over the past few years:

- In 2015, software businesses that generated $20K – $110K in net profit would fetch on average a 2.53x multiple. The businesses that did $115K-$600K in net profit would fetch 3.63x on average. Those were the two largest groupings for 2015 and they demonstrate the difference in multiple based on the profit size.

- 2016 brought a similar trend but with a more drastic contrast. The smaller profit businesses (again the $20K-$110K range) only averaged 1.92x. The medium-sized profit businesses (up to $600K) would sell for an average of 3.37x.

- In 2017, the data corroborated the same finding but with higher multiples all around: 2.28x multiple for smaller profit businesses and 3.88x for medium profit businesses.

- In 2018 and 2019, you can also see the higher multiples for the larger-sized businesses:

2018:

| Price Bucket | Avg Multiple for Software |

| 0-$250K | 2.53 |

| $250-500K | 1.42 |

| $500K-$1M | 3.23 |

| $1-2M | 3.07 |

| $2-7M | 3.92 |

| Over $7M | 4.45 |

2019:

| Price Bucket | Avg Multiple for Software |

| 0-$250k | 2.2 |

| $250-500k | 2.45 |

| $500k-$1 Million | 3.76 |

| $1-2 Million | 3.54 |

| $2-7 Million | None |

| Over $7 Million | 5.0 |

For 2020, you can see that the largest deal commanded the 6.4x multiple for the $2.5M in earnings, and the rest are mostly in the 3-4x range:

2020:

| Price Bucket | Avg Multiple for Software |

| 0-$250k | 3.95 |

| $250-500k | 1.83 |

| $500k-$1 Million | 2.89 |

| $1-2 Million | 3.29 |

| $2-7 Million | 3.65 |

| Over $7 Million | 6.40 |

For 2021, it’s apparent that the deals over the $7M price point commanded the highest multiples, with deals in the $1M-$7M range also beating the average.

2021:

| Price Bucket | Avg Multiple for Software |

| 0-$250k | 2.86 |

| $250-500k | 2.69 |

| $500k-$1 Million | 3.63 |

| $1-2 Million | 4.14 |

| $2-7 Million | 4.10 |

| Over $7 Million | 5.00 |

Multiples by price bucket:

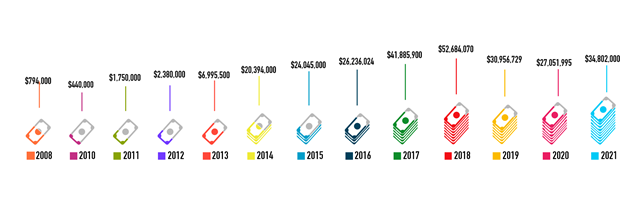

So, if we look at a quick summary of the past 4 years in software business sales…

- Software companies were valued at an average of 3.36x multiple

- Software businesses sold for an average of $1,603,728

- Software companies generated more than $145 million in transaction value combined

Now that you know the numbers — how does your Software business stack up against the current market?

Here’s How to Sell Your Software Business in 2022

The process of selling your software business will vary depending on the size of your company, but generally follows this straightforward process:

- Get a valuation of your business so you know what it’s worth

- Put together the prospectus (facts, figures and numbers about your business)

- List your business on a high-quality investment platform like Digital Exits

- Negotiate a price with potential buyers (or have an agent handle this for you)

- Conduct due diligence to verify the buyer’s financials

- Transfer all assets and money

- Help transition the new buyer into running your business

If you want to find out how much your business is worth right now, our dedicated team at Digital Exits can help.

With decades of experience in high-value business investments under our belts, our appraisal and vetting resources are unmatched in today’s market.

Where Can You Sell Your Software Business?

Small Business Marketplaces

Smaller software business and micro-businesses are usually best sold privately by the owner through forums or classified websites.

To sell your small business, check out:

- Flippa – Best for businesses under $100K in yearly profit

Broker

Medium-sized businesses in the $100K-$20M range are best sold through brokers who help with finding buyers and negotiating and structuring the deal. To sell your medium-sized business, check out:

- Digital Exits – best for software businesses $100K – $1M in yearly profit

Investment Banks and Merger & Acquisition Companies

Larger software businesses with yearly profits more than $1M are best sold through investment banks or merger and acquisition companies. To sell your large business, check out:

- Business Exits – best for software businesses making over $1M in yearly profit

We’ll help you get the most accurate valuation for your business, and match you with the best potential buyers in your niche.

Our specialty is connecting buyers and sellers in high-value transactions that represent only the absolute best companies on the market today. Buyers invest confidently knowing they’re getting the highest quality businesses, and sellers can relax knowing they’re listed among only the highest-value companies available.