Shark Tank is one of the most popular shows on television right now, and there are several reasons why. Viewers love the idea of normal people chasing the “American Dream” through entrepreneurism. Often the stories and ideas are inspiring, and when you combine that with the highly varied personalities (and humor) of a few billionaire/millionaire “sharks,” then you get a hit show.

In addition to the sheer entertainment the show provides, Shark Tank can teach us a lot about business as well, especially when it comes to seeking investment and how to pitch an idea.

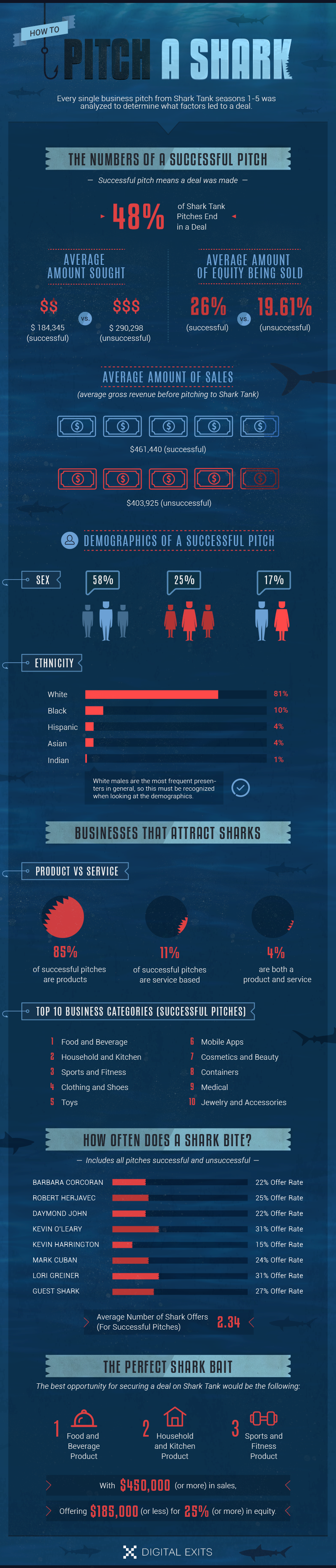

We watched every single episode, and analyzed every business pitch from Shark Tank Seasons 1-5. Our study reveals exactly what an entrepreneur needs to know in order to make a deal, and not get eaten alive.

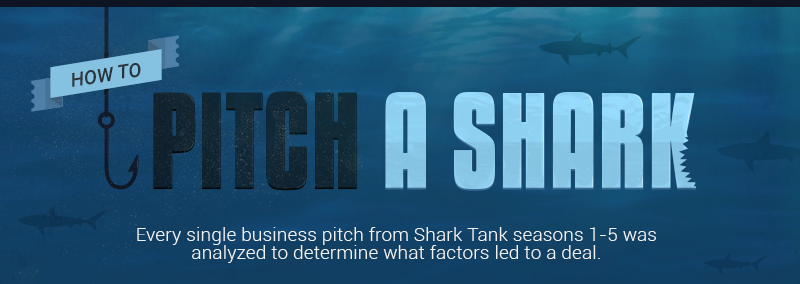

Surprisingly, almost half of Shark Tank pitches are successful (end in a deal). Though it should be noted that many of these deals never actually come to fruition, as the sharks (and most likely their lawyers) are allowed to review the financials of the business and make a final decision after the initial pitch and deal are made. Regardless, we can still learn a lot about what these investors are looking for in a business presentation.

Like most savvy investors, the sharks are looking to get the largest amount of equity for the smallest investment. According to our research, the sweet spot looks to be an investment of less than $200,000 for 25% or more in equity. Unsuccessful pitches were seeking an average of $300,000 for around 20% equity.

When it comes to sales (which is probably the number one thing the sharks inquire about) the average number between successful and unsuccessful pitches is actually fairly close (near a half million dollars). This is likely due to some of the unsuccessful pitches having extremely high sales numbers, yet very little profit. We would have liked to include net profit in our analysis, but unfortunately this was not revealed on a consistent basis.

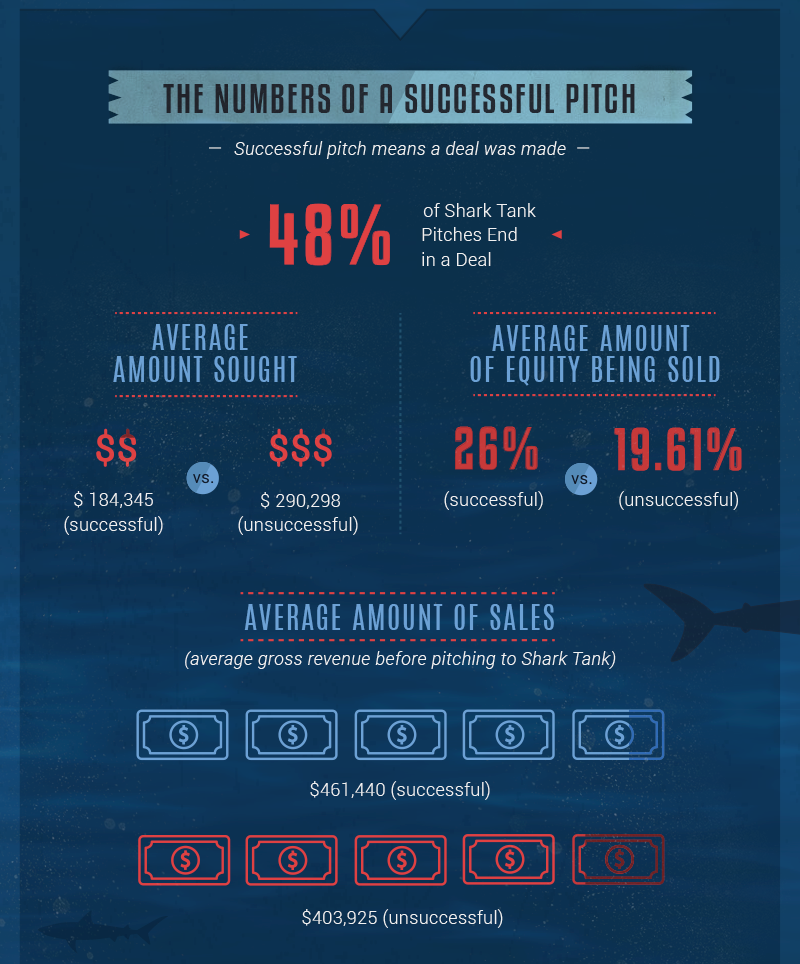

The demographics of successful Shark Tank presenters are pretty one sided, as over half are male, and 81% are white (caucasian). However this statistic doesn’t hold much weight as white males are by far the most common presenters in general (successful and unsuccessful).

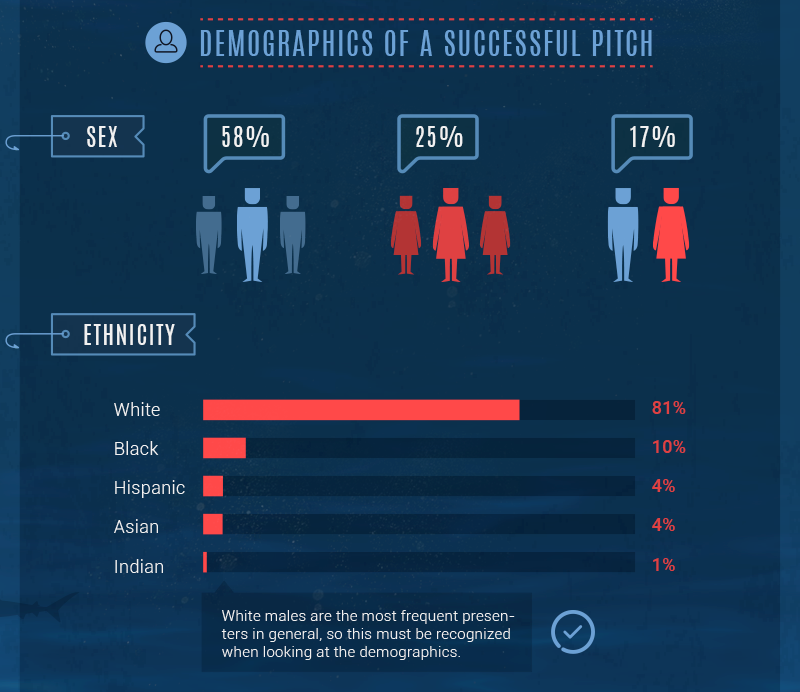

One of the most common lines you will hear on Shark Tank (besides Mr. Wonderful’s “You’re dead to me.” or Mark Cuban’s “You’re a wantrepreneur not an entrepreneur.”) is one of the sharks telling the presenter that he or she has a product, not a business. But when a presenter DOES have a solid business to go along with the product they have created… the sharks often start to frenzy. 85% of successful pitches are primarily product based. The most common reasoning for this is that service based businesses are hard to scale to a size where the sharks would make a large profit.

In addition to this, the sharks seem to like products in the following three categories:

- Food and Beverage

- Household and Kitchen

- Sports and Fitness

Just like real sharks, some bite more than others. When looking at all the pitches (successful and unsuccessful) we were able to determine which sharks make the most offers. Kevin O’Leary (Mr. Wonderful) led the pack with a 31% offer rate… however it should be noted that O’Leary’s offers are often rejected by the entrepreneur because he often makes a royalty in perpetuity proposal, rather than a straight equity deal. Lori Greiner also has a 31% offer rate, but she has a much higher success rate in regards to closing an actual deal.

Kevin Harrington had the lowest offer rate, however it should be noted that he was only in seasons 1 and 2 of the show.

Taking all of this information and data into account, we believe we’ve come up with “the perfect shark bait.”

To have the greatest chance at securing a deal with one of the sharks, you need to have a product based business in the food and beverage, household and kitchen, or sports and fitness category. In addition, the business should have $450,000 or more in gross sales.

When making the offer, one must remember that these sharks are hungry for equity, so they’re going to be very aggressive. If the above business criteria were met, an offer of $185,000 (or less) for 25% (or more) in equity would be very hard for them to turn down.

In conclusion, to successfully secure a deal on Shark Tank, an entrepreneur must remember the following:

- Product based businesses are the most successful in terms of getting an offer.

- The sharks like products in the food and beverage, household and kitchen, or sports and fitness categories.

- The entrepreneur MUST “know the numbers” such as sales, profit, and margins.

- The entrepreneur should have a realistic valuation.

- The business should have solid sales numbers.

- The sharks love businesses that are highly scalable and have high profit margins.

- The business should be fairly established (rather than brand new or just at the idea phase).

- The sharks are likely going to want 20% – 25% or more in equity.

- The sharks love anything that is proprietary and has the option to be licensed.

If a business has many of these qualities, and the entrepreneur presents them effectively, then they can definitely expect to leave the Shark Tank with a big catch.

Full Infographic

Fair Use: Feel free to share and post this image. If doing so, please link back to Digital Exits so that your audience may view the full analysis and methodology.