To sell your website for 6 or 7 figures there are a variety of factors that come into play. The main factor is the net earnings (total income minus expenses) that a website makes. Although there are some examples of websites being sold that make no revenue, this article is defined by the parameters of a money generating investment, were potential investor’s are looking for a return on investment.

To sell your website for 6 or 7 figures there are a variety of factors that come into play. The main factor is the net earnings (total income minus expenses) that a website makes. Although there are some examples of websites being sold that make no revenue, this article is defined by the parameters of a money generating investment, were potential investor’s are looking for a return on investment.

The following 5 factors are the main things that investors will be looking for before they hand of 6 or 7 figures in cash to pay for an online business.

Examples of 6 and 7 figure sales:

Have a look at the following examples of 6 and 7 figure sales that have been talked about publicly.

The Attributes

- Profit

- Growth

- Strong brand

- Other assets (including mailing lists, database etc.)

- Systems Process

- Defensibility

- Little Owner Involvement

- Diversified Income and Traffic

The Process

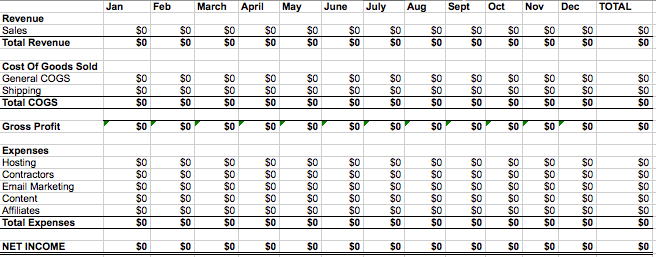

- P&L at least 3 years (including owners salary)

- Selling Document (what is required in this)

- Market The Business (including where to find buyers)

- Examples Sites Brokered For 6 Figures

- Letter Of Inten (Offer including Deal Structure)

- Negotiation

- Close

Income: Target EBITA (earnings) Multiples

The total profit a website makes is the main factor contributing to a 6 or 7 figure deal. The general valuation method that investors use to value an online business is the ‘multiple of earnings’ method. This means that an investor will take the net earnings of a business and multiply it by a multiplier (Usually 1.5-3x) to determine what they are willing to pay for the business.

For example:

The ecommerce store www.bowlingballs.com earn’t $345,679 in net profit in the last 12 months.

Buyer A

Because the business has a great domain, strong earnings, is growing, a variety of traffic sources, strong repeat sales a potential investors sees the business as a solid investment and thinks that a 3 times multiple is the risk they are willing to take on the business. Therefore they offer 1.03 million for the business.

Buyer B

Although the business has a great domain, strong earnings, is growing, has a variety of traffic sources, and repeat sales. Investor B thinks that there is too higher reliance on SEO traffic for the website (68%) therefore they think that the business is a riskier investment and only offer 2.4 times earnings. Therefore they offer $830,000 for the business.

Generally the lower the multiple the higher the risk of the business and the higher the multiple the lower the risk of the business.

- 1x multiple = money back in 12 months

- 2 x multiple = money back in 2 years

- 3 x multiple = money back in 3 years

- 4 x multiple = money back in 4 years

There statistics have been gathered from online classifieds website flippa.com, online business for sale sites, website brokers and forum data. They are the average website multiple across 10 sales per category.

Minimum income required

The following table shows the monthly profit levels required to achieve a 6-figure sale and a 7-figure sale.

| 1 x earnings | 2 x earnings | 3 x earnings | |

| 6 Figure Sale | $8,333 per month | $4167 | $2,777 per month |

| 7 Figure Sale | $83,333 per month | $41,677 per month | $27,000 per month |

How to attract a multiple EBITDA over 3X

There are two main ways to attract an offer over 3 times earnings

- Strong growth

- Strategic acquisition

Both methods involve the purchaser of that company to see a strategy to get a quicker return on investment through a certain synergy or economies of scale through the acquisition.

Proof of that income

It’s great to have a profit and loss statement with solid income and profit but without being able to prove that income you don’t have a leg to stand on. Firstly

having your books in order is imperative. Audited accounts by an accounting firm are even better for larger transactions. Net books means that when a potential buyer is going through due diligence with you suddenly have to add in extra expenses that you failed to add, or you found an extra income channel that you misplaced.

Honesty is great and it establishes trust, however if you start adding or subtracting elements to your balance sheet in the process of due diligence someone looking at the business is going to think what else am I not seeing or what other information have they forgotten about and it can harm the deal.

Email me for a copy: [email protected] – if you want a copy of the template P&L document from the above article, email me for a copy.

Growth trends

A growing site attracts a higher offer. What buyers are looking for is how quickly they can get their money back. If for example have a website that generated $200,000 in net profit in the last 12 months and it looks on track to do $250,000 in net profit in the net 12 months, a buyer is going to pay a higher price for the business because they are going to get their money back a lot sooner with the growth of the business.

Systems and process

Systemized income (having a process to generate income) is much more valuable than active income (selling time for $$). The goal of your business is to extract you as the owner. Then instead of having a job, you have a business and a business is something that can be invested in. Buyers look for a systemized way of making money and if that system requires a lot of work from you as the owner, buyers are to pay less for the business.

Things like:

- Systemized processes

Diversified income

A table with one leg doesn’t stand up very well. Therefore a business with only one customer or one source of revenue doesn’t elicit a lot of confidence for potential buyers.

Having a business that has multiple customers or revenue sources is deemed as a lot less risky than a business without.

Note: if your business rely’s on one source of income, however that source of income is easily interchangeable with another supplier or revenue source than this rule does not apply to you. For example if you make money selling web hosting, you could easily change to a different hosting suppliers quite quickly that provided a similar product.

Diversified traffic

As with diversified income, also diversified traffic is also a factor for a 6 or 7 figure sale. Again using the same analogy an online business with only one main source of traffic is a very risky business.

Especially with the continuing Google updates a site that has a high reliance on search engine traffic is very risky. Similar with a high reliance on Facebook traffic. If you lose that source of traffic overnight, you lose your business overnight.

FAQ

What are the chances my website will sell?

How can I determine it’s value? / What can I get for it?

How can I increase the value and make it more saleable?

How long will it take to sell? / When will I get the money?

What happens when we find an interested buyer? (due diligence, escrow process etc.)

Have you sold websites like this in the past?