The debate continues to rage between the viability of the dropship model. On one side of the argument is drop-ship will always have a role in the market and on the other is that it will slowly be phased out. I have my own opinions however I thought it would be a good idea to get the thoughts of other ecommerce experts on the subject.

Ecommerce Versus Dropship

Drew Sanocki

(www.drewsanocki.com) Drew runs the popular ecommerce blog about hacks for ecommerce executives. He has a book, Masterclass and coaching that he provides for readers and fans.

(www.drewsanocki.com) Drew runs the popular ecommerce blog about hacks for ecommerce executives. He has a book, Masterclass and coaching that he provides for readers and fans.

Too many people make “dropshipping the operational approach” into “dropshipping the business strategy”. Of and by itself, it’s simply a tactic, like employing white glove shipping or next-day delivery. If it makes sense for your business, use it — if it doesn’t, don’t. It’s not going anywhere — financially it will always make sense to ship once (from a vendor) as opposed to twice (from a vendor to a retailer and then a retailer to a customer) for certain products.

Trouble comes when you make it into a business strategy. That’s like saying “we are a ground shipping retailer”. That doesn’t make any sense. Only a handful of retailers might define themselves by their delivery method — Kozmo, Postmates, etc. — and I’m guessing the readers of this article aren’t among these retailers.

Instead, you’ve got to do the fundamental things that eek out a competitive advantage. Build a brand, offer proprietary merchandise, etc. Once you’ve done this, thing about whether it makes operational sense to drop-ship your product. But don’t put the cart before the horse.

Andrew Youderian

(www.ecommercefuel.com) – Andrew runs Ecommerce Fuel, a blog that is dedicated to sharing insights and lessons learned from running his own ecommerce businesses, and is written especially for individuals and small teams hoping to start, grow and operate their own online stores.

(www.ecommercefuel.com) – Andrew runs Ecommerce Fuel, a blog that is dedicated to sharing insights and lessons learned from running his own ecommerce businesses, and is written especially for individuals and small teams hoping to start, grow and operate their own online stores.

What is the future of dropshipping?

“I’ve been a full-time eCommerce entrepreneur for more than six years and used drop shipping exclusively. That being said, my next eCommerce business will not be a drop shipping model.

Why? Drop shipping is fantastic to get started when capital is tight, to test out new markets, to supplement your in-house products or if building a location independent business is extremely important for you. But building a sizable and profitable drop shipping business can be difficult because everyone else has access to the products you’re selling, which often leads to price wars.

It’s definitely not impossible. Again, I’ve been doing it for half a decade with success – but it does take a lot of work and a very carefully thought out niche. You need to pick a market where you can add a lot of informational value to your product – or a very unique branded experience – or else you’ll struggle to do well.

Building your own product or brand takes more time up-front, but is a more much more defensible business long-term and offers the highest ROI. So while I’ve really enjoyed drop shipping and know it’s possible to make it work, I won’t be choosing it for my next business model given I’m looking to maximize my returns in the long run.”

Ian Shoen

(www.thevaletspot.com) Ian owns and operates a number of businesses in the ecommerce space also is also the co-host of the popular online business podcast the tropical mba podcast.

What is the future of dropshipping?

I define dropshipping as buying and reselling someone else’s product and never paying for inventory. By virtue of it being easy I don’t think it will be valuable in the future because you have to compete with amazon and the manufacturer. I think you do it purely for research value and learn about the product and then you go put and create your own company off that. It’s much easier now for a manufacturing company to do their own sales and marketing. By making your own products there is more valuable intellectual property, goodwill and the ability to add more services to the product offering.

Leighton Taylor

(www.ecommercepulse.com) – I’m here to help you start a successful ecommerce business and find more freedom and fulfillment in life. Stick around for free articles, tutorials, and a podcast designed to help you build a thriving business and achieve your goals.

(www.ecommercepulse.com) – I’m here to help you start a successful ecommerce business and find more freedom and fulfillment in life. Stick around for free articles, tutorials, and a podcast designed to help you build a thriving business and achieve your goals.

What is the future of dropshipping?

I think the drop ship model will continue to exist as long as that model makes sense for the manufacturer of the product. If manufacturers can profit by offering to drop ship for their retailers, they’ll do it. However, some manufacturers may discover that it’s just easier and more profitable to sell direct to consumer on Amazon. I predict that the drop ship model won’t go away, but that it will continue to grow more difficult for retailers to differentiate themselves and make significant profits.

Terry Lin

(www.buildmyonlinestore.com) Terry owns the widely popular ecommerce podcast and blog Build My Online Store where he interviews successful ecommerce store operators about their experience running a profitable ecommerce business.

(www.buildmyonlinestore.com) Terry owns the widely popular ecommerce podcast and blog Build My Online Store where he interviews successful ecommerce store operators about their experience running a profitable ecommerce business.

What is the future of dropshipping?

While dropshipping is a great way to get started in e-commerce with low financial risk and no inventory overhang, entrepreneurs taking up this business model will need to really think through their differentiating angle to the end customer. With minimal barriers to entry, lower margins (10-30% on average), and no ownership in manufacturing, dropshippers require a large revenue base to make any sort of meaningful net income.

As the dynamics between paid and “free” advertising channels become more complicated, dropshippers will find it more challenging navigate due to budget constraints that originate from their lower product margins. But the advantage dropshippers have is market knowledge and an existing customer base. From there, they can consider sourcing inventory for bestselling products, private label their own brand, or go down the manufacturing path.

Richard Lazazzera

Richard Lazazzera – (www.ABetterLemonadeStand.com) – Richard runs the blog and community at A Better Lemonade Stand. His blog is dedicated to helping new ecommerce entrepreneurs figure out what to sell online and provide them with the necessary advice, resources and tools to get started.

What is the future of dropshipping?

With low startup costs and almost no barriers to entry, dropshipping is seen as an ideal to start point for many new ecommerce entrepreneurs. However, dropshipping has always been a difficult business model and continues to get harder. Slim margins make it hard to compete. Tactics like paid advertising and discounting are difficult if not impossible to do effectively in the dropshipping space.

What is many times sold as a easy way to start an online business has actually become one of the hardest. There is no easy money is dropshipping. It’s a long road uphill and the hill continues to get steeper.

With that said, the dropshipping model will continue to exist because it’s beneficial to manufacturers. However, I would caution new entrepreneurs to strongly consider their niche before getting into it. They days of selecting a niche, finding a dropshipper, doing a bit of SEO and making sales is done. You better love what you’re doing because you’re going to be spending a lot of time doing it.

Shabbir Nooruddin

(www.bootstrappingecommerce.com) is a blog about building an ecommerce business on a shoestring budget.

(www.bootstrappingecommerce.com) is a blog about building an ecommerce business on a shoestring budget.

What is the future of dropshipping?

“Drop shipping is getting tougher and tougher, but as long as you can find a way to differentiate yourself from everyone else, you can succeed. I think drop shipping is evolving from a regular niche site to a super-specialized niche site where your target market is a niche within a niche. Many successful drop shippers have already embraced this philosophy and are seeing good results. From a business and money perspective, you could successfully grow a drop ship business to a million dollars or more in revenue, but it’s more like something you’d want to use as a stepping stone to manufacturing or sourcing your own products. Margins are tight, costs are high, and competition is tough, so you’ll do well if your in it for the long haul.”

Andrew Egenes

(www.shoplio.com) Shoplio owns and operates a network of speciality and niche online stores in various markets including home goods and protective covers.

What is the future of dropshipping?

I believe dropshipping will always be a legitimate catalyst for quickly and cost-effectively entering new, immature, or unproven markets. However, I also believe the Internet will only continue feeding and supporting a price conscious mindset among online shoppers. As a result, I think companies operating off an exclusively dropship-based business model will increasingly be forced to consider sourcing and securing at least a portion of their catalogs to remain competitive in what I see as an ever more price sensitive and price competitive e-commerce future.

Jason Guerrettaz

(www.websiteclosers.com) Jason is the co-founder of website closers, a brokerage that has been helping selling online and ecommerce businesses since 1998.

(www.websiteclosers.com) Jason is the co-founder of website closers, a brokerage that has been helping selling online and ecommerce businesses since 1998.

What is the future of dropshipping?

As owners and brokers of digital assets, we see the answer differently depending on our stake. Our process as site operators has been to evaluate the ability to compete given supply and demand marketplace dynamics. Based on these dynamics, we will generally stock those SKUs that perform well in order to maximize margins and compete. But so much more can go into the decision making process of moving a SKU from drop ship to stock; including, whether the Manufacturer has made the decision to sell product directly on its website, on Amazon or on other marketplaces. Also of importance is whether Minimum Advertised Pricing rules have been put in place. These market dynamics continue to evolve, and thus, we continue to monitor the marketplace and our competitors to identify whether a SKU should be stocked or drop shipped.

When we represent a Seller that wholly or primarily drop ships product, we find that some Buyers are interested in the business because they don’t have to manage or deal with the costs associated with inventory management, whether it be in a warehouse or via a third party fulfillment company. Buyers also look at drop ship Internet companies as an opportunity to increase operating margin to offset the cost of debt service.

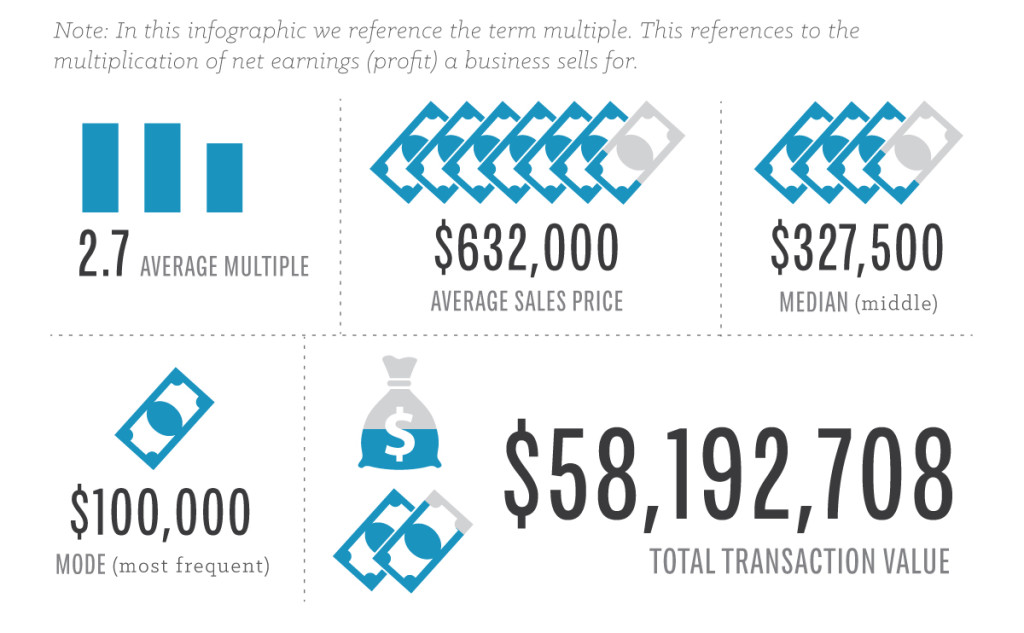

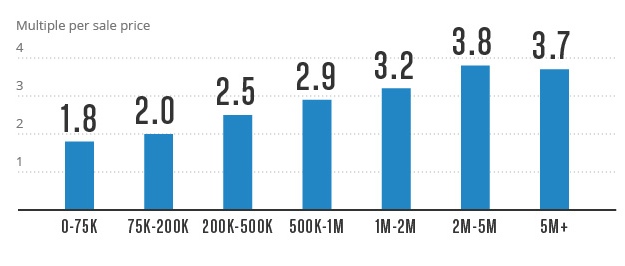

But as to the value of a drop ship model versus that of an inventory hold business, we are not currently seeing a higher multiple from either model. Multiples tend to be more tied to top/bottom line trends, the category served, the opportunity for scale and the strength of the brand.

Thomas Smale

(www.feinternational.com) Thomas is the co-founder of FE International, a website brokerage the helps people sell their online business. They were established in 2010.

(www.feinternational.com) Thomas is the co-founder of FE International, a website brokerage the helps people sell their online business. They were established in 2010.

What is the future of dropshipping?

In recent years, dropshipping has got more and more popular. As less internet savvy people get online, running a relatively simple e-commerce business (dropshipping vs. holding your own stock) is extremely attractive. Whilst profit margins may not be as high as stocking and shipping yourself, for the average hobbyist/small business owner, it is ideal due to the lack of moving parts and relative simplicity.

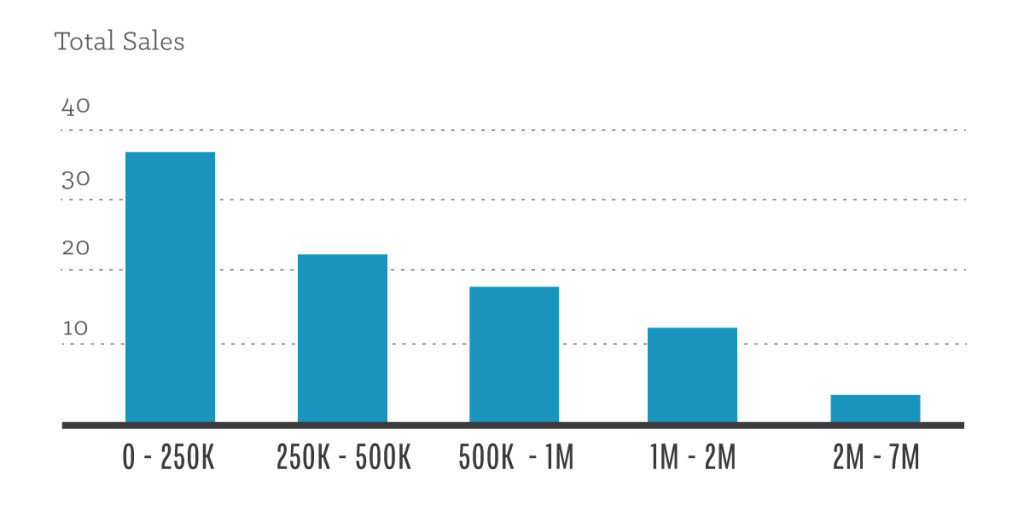

Demand will continue to grow for dropshipping businesses, particularly in the sub-$100k range where the majority of first-time buyers are. First-time buyers generally want something easy to run and are far more comfortable dropshipping than anything else. It is very rare to see websites at the $100k+ net profit a year level that are entirely dropshipped. With relatively low margins, they can be hard to scale, and as a business grows it makes sense to build an infrastructure (whether that is through a fulfilment service like Amazon or stocking and shipping product out of a small warehouse). I don’t expect to see much more supply at the mid-high end of the market, but in the sub-$100k range I expect supply to be stable and multiples to increase as demand continues to outstrip supply.

(www.quietlightbrokerage.com) Mark is the founder of Quiet Light Brokerage. A premium website brokerage established in 2007.

(www.quietlightbrokerage.com) Mark is the founder of Quiet Light Brokerage. A premium website brokerage established in 2007.

What is the future of dropshipping?

Dropshipping sites have been extremely popular among buyers and I believe they will continue to be popular. For first time buyers, I often recommend dropship sites as the business model resembles business models that they will be familiar with, and the benefits that dropship sites offer (relatively low-work load, automation) give first time buyers a good taste for what is possible with Internet businesses. When I am evaluating a dropship site, one of the first areas I look towards is whether it has any distinguishing factors. Do they have special pricing with their vendor that others won’t get? Do they have a unique mix of products that is unlike their competitors? Do they have any exclusive rights?

The worry buyers often have with dropship sites is that the barrier to entry can be relatively low, especially if a vendor has an open door policy, automated feed, and no oversight of resellers. These types of sites, however, get filtered out pretty quickly in the acquisition space (or they sell for very low multiples). If you have a dropship site, you should work on making your business unique. Overall, I don’t see the demand for dropship sites declining. If anything, I would guess the demand for these businesses will actually increase.

Julie Neumann

(www.bigcommerce.com) Julie manages all the content at ecommerce platform Bigcommerce. Her work has been featured in Entrepreneur, Inc, Washington Post, Yahoo!, TechCrunch, VentureBeat, Spin and more.

Tony Loya

Tony Loya has been with the Volusion team for more than 3 years and manages Technology Partnerships. In his free time Tony enjoys all things to do with bicycles and Chinese gadgets. To earn more about using Doba drop shipping with Volusion, please visit: https://www.

“In the future, online businesses will continue to reap the benefits of drop shipping, if not more so than they do now. But when choosing most ecommerce business decisions, it has to fit in with the business’ structure. If drop shipping fits into that model, business owners have the potential to utilize drop shipping to save money, give them additional flexibility, and minimize risk & waste to support and improve their online business for years to come.”

What is the future of dropshipping?

“Drop shipping can be a great way to get an e-commerce business off the ground, expand and test new products. The minimal overhead costs make it appealing to a wide range of merchants. And that means it is becoming an extremely competitive space. Differentiation will be key moving forward. Merchants need a unique niche or identity plus a solid strategy to succeed. The time they save with drop shipping should be spent building a brand, connecting with consumers, establishing themselves as experts and looking for ways to stand out from the crowd. Drop shippers will find success providing white label services, helping merchants extend their brand and providing a superior customer experience. To maximize profits, everyone should embrace a new mantra: always be adding value.”