By Robert Kale and Jock Purtle

The Fulfillment by Amazon (FBA) business model is fast becoming a serious model in the online business space. Some sites see it as the top way to make money online in 2024. For example, companies like Amazing.com have developed a whole new breed of entrepreneur and we are starting to get lots of requests from Amazon business owners for a valuation on their business. Selling your FBA business is an attractive investment for someone without the skills and the knowledge to start a business, but wants to buy one that is easy to manage. That is why we have analyzed the 2021 data on Amazon FBA businesses that have sold to come up with this Amazon FBA business valuation report.

As you can see from the graph below, there was a big spike in Amazon FBA business sales in 2017 and then it normalized in the following years, though 2021 did see another upwards spike.

What is your Amazon FBA business worth?

The value of your Amazon business is in its ability to produce profit. So for example, if your business made $1M in sales in 2017 and your profit (SDE, or Seller’s Discretionary Earnings) was $250,000, then your business would be a multiple of that $250,000 profit. We are seeing the market pay 2-4 times the SDE for Amazon FBA businesses, so depending on the products, attractiveness to a buyer, and transferability, the business would be valued between $500K and $1M.

The profit of your business is calculated as = Total Sale – Cost of Goods Sold – Expenses + Owners Wage

Where your business sits in the range of 2-4 times profit depends on a range of factors including: age of the business, niche, product diversification, number of SKUs, growth, and competitive landscape.

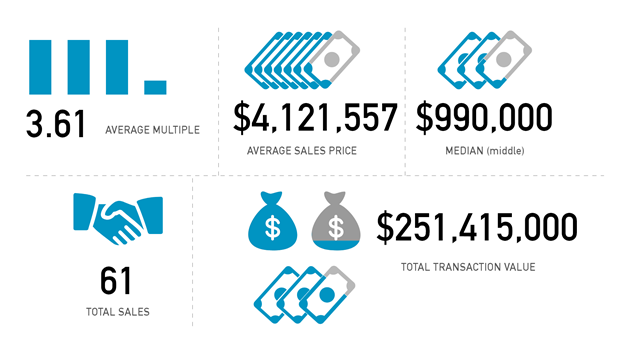

We have put together some data for transactions in 2021 for Amazon FBA businesses:

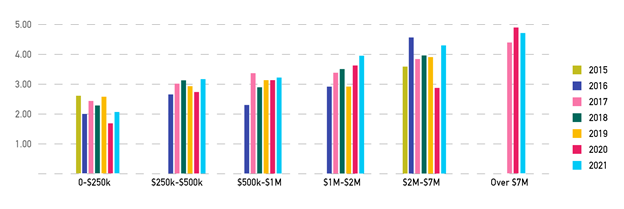

***This table shows the average multiple in each price range.***

How To Increase the Value of your Amazon Business

The amount a buyer is willing to pay for your business will all come down to one thing — return-on-investment (ROI) and relative risk. The lower the risk, the higher the price, and vice-versa. With that being said, what really makes your Amazon FBA business worth more is mitigating the risk of the business failing in the future by having the following characteristics associated with your online store:

- Age – the older your business, the more value it has to a buyer, as they can see the track record and growth trends. It’s harder to project future earnings for a business that is a year old versus a 3-year-old business with a more stable history.

- Niche – a hyper-competitive niche like iPhone cases is a much harder market to compete compared to, for example, table mats specifically for marble tables. The market matters and your positioning in that market will affect valuation.

- Concentration of products – having one product that makes up 80% of your sales is a big risk to a buyer. You can demand a higher price if you have a more evenly distributed revenue by product.

- Brand – having your own branded and manufactured product creates a certain level of competitive advantage against copycats who are just reselling items (i.e. from from Alibaba).

- Amazon Best Sellers Rank – if your BSR rank has grown consistently over time, it’s a good sign to a buyer that you provide a quality product and have great customer service.

- Suppliers – having quality suppliers that are dependable, deliver product in a timely fashion, offer good terms and reliable fulfilment instills more confidence for the buyer.

How does the selling process work?

The selling process is fairly straight-forward but can be more complex and take more time depending on the size of the business. In general, most sales will be structured like this:

- You decide to sell

- You get a valuation of your business

- Develop a prospectus (all the facts and figures about your business)

- Find potential buyers for your business (whether you use a broker or sell it yourself)

- Negotiate a price with potential buyers (total price and also terms of the deal)

- Transfer the assets to buyer, and conversely, money to seller

- Help train the new buyer to run the business

Where Can You Sell Your Amazon Business? Best Amazon Business Brokers

SMALL BUSINESS MARKETPLACES – (UNDER $100K)

Smaller Amazon business and micro-businesses are usually best sold privately by the owner through forums or classified websites. This applies to Amazon businesses making less than $500,000 in sales per year.

To sell your small business, check out:

BROKER – ($100K – $20M)

Medium-sized Amazon businesses in the $100k-$20m are best sold through Amazon business brokers who help with finding buyers and negotiating and structuring the deal. These are Amazon businesses doing at least $500,000 per year in sales. To sell your medium-sized business, check out:

INVESTMENT BANKS AND MERGER & ACQUISITION COMPANIES – ($20M+)

Larger businesses are best sold through investment banks or merger and acquisition companies. To sell your large business, check out:

- Business Exits – great if your business is making over $4M in profit per year

What does it cost to sell my Amazon FBA business?

A website broker will generally charge 10-15% of the gross sale price to sell your Amazon business depending on the size of the business.

How long does it take to sell my Amazon FBA business?

The time it takes to sell an Amazon FBA business depends on the individual business and terms of the deal. Generally, larger deals (over $1M) will take longer to sell than smaller deals (under $300K) because of the complexity of the business and the risk that a buyer is taking. With regards to our deals, over 50% close within 90 days and over 70% close within four months.

Who will buy my Amazon FBA business?

There are 3 main types of buyers of Amazon FBA business that we have seen to date:

- Corporate Exec – this is someone looking to buy his or her first business. They usually are a high-paid employee or C-level executive with disposable cash, IRA, savings, or access to a SBA loan.

- Internet Entrepreneur – individuals who have been in the industry for a while and have a good understanding of what it takes to run a digital business. They are either fresh off of a recent sale of their last business or looking to add a business to their portfolio.

- Brick and Mortar Entrepreneur – generally these are entrepreneurs who have exited or still own their company and are looking for a move into the digital space.