2016 Business Valuation Report: Metrics from 234 Companies Sold Across 6 Business Models

If you’ve followed along with us for any length of time, you know that at Digital Exits we ONLY list the best quality companies, and that our vetting process for both buyers and sellers is second to none.

One of the most important lessons we’ve learned through many years of working with these high-value businesses is that the more facts and relevant information you have, the more power you have to make profitable decisions.

In short – you’ve got to know your numbers.

What is YOUR Business Worth?

Understanding how much your business is worth in relation to the current market helps you accelerate your growth, and more importantly, make strategic decisions to move in the right direction.

As part of the value we provide for our clients, we invest a significant amount of resources into collating, organizing and analyzing valuation metrics in order to continually improve our listing and vetting processes.

After the incredible response to last year’s report, we’re back with a brand new Business Valuation Report for 2016.

We analyzed 234 businesses from 6 different business models to help high-value investors get a competitive advantage in the current market from 2016 Sales Data

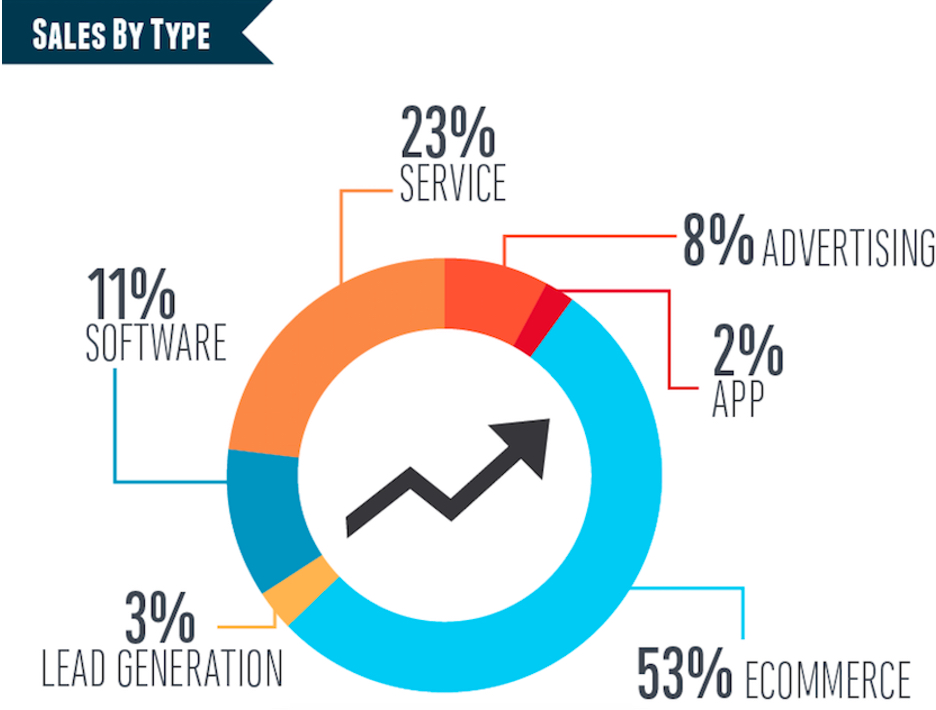

In total we analyzed over 200 businesses sold in 2016 across these industries:

- Advertising – this type of business generates revenue through ads or affiliate offers

- App – these are mobile apps that generate revenue through paid downloads, membership or advertising

- eCommerce – including traditional eCommerce stores, drop-shipping and digital products

- Lead Generation – these companies generate revenue through selling leads

- Software/SAAS – includes any other application-based business

- Service – businesses that generate revenue through providing a service

Here's what we found:

You can see that the popularity of eCommerce businesses is still holding strong from last year, and the sale of Lead Generation, Advertising, and App-based businesses has changed very little since 2015.

On the other end of the spectrum, the sale of Software companies has dropped significantly in the last year – with the number of Software business sales decreasing by 10%. In contrast, service-based businesses are on the rise, growing 14% in the last year.

However, that doesn’t mean that companies in smaller niches such as Software are not profitable. We’ll take a closer look at that in a minute, but first let’s dive deeper into the trends among business sales in 2016.

Here are the trends we found in 2016 business sales:

- Out of 234 sales, the average valuation Multiple was 2.27

- These businesses sold for an average of $555,998

- The total transaction value was over $130 million.

- Businesses sold most frequently for around $500,000

- eCommerce businesses were most desirable to investors, while high-value App-based businesses were few and far between.

While it looks like eCommerce is the safest bet at the moment, that doesn’t mean it’s the most profitable type of business.

Let’s take a closer look and break down the valuation metrics for each type of business model.

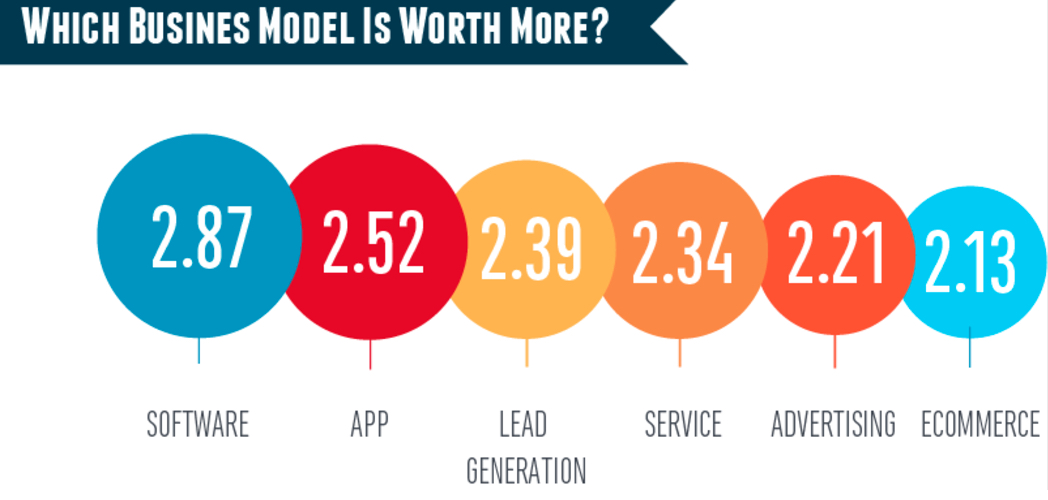

What is the Average Multiple for each Type of Business Model?

For those who don’t know, the term “multiple” refers to how much a business is worth at the time of sale. The value of a business is calculated by multiplying the amount of profit a business makes, by the valuation multiple — like this:

$$ Profit amount x Multiple # = Appraised value of the business.

For example, if a business nets $500,000 in profit, and is estimated to sell at 3x multiple, then the business is predicted to sell for approximately $1,500,000.

$500,000 x 3 = $1,500,000

The question is – which TYPE of business model is most valuable in the current market?

As we’ve already covered, eCommerce companies were the most popular business model to sell in 2016, but they were NOT the most profitable. In fact, these companies sold at the lowest average multiple of 2.13x.

While the number of Software businesses sold in 2016 was far less than the year before, surprisingly, these businesses sold for the highest multiple. In fact, while Software companies sold for an average of 2.87x multiple, the highest multiple was a whopping 8.29x in September of 2016. Now that’s a great ROI.

To learn more about buying and selling software businesses in today’s current market, take a look at our Software Business Valuation Report.

For now, let’s take a closer look at how business size and revenue impacted how much these businesses were worth.

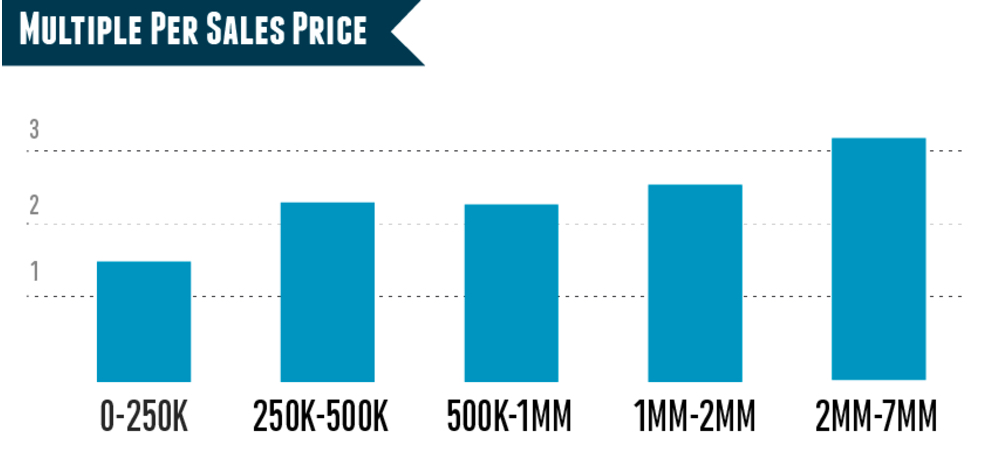

How Were Valuation Multiples Impacted By Business Size in 2016?

Interestingly enough, the higher-value companies fetched a higher valuation multiple. Which makes sense, since this shows that buyers were willing to invest at a higher multiple for businesses that were already performing well.

Frequently, businesses with over $2 million in gross income sold at over 3x multiple — with the average multiple being 2.19x for companies of this size.

Towards the lower end of the graph, businesses which brought in less than $250,000 gross income sold for an average of 1.52x multiple.

Here's how those sales were distributed:

This data shows consistency over the past few years – with investors buying larger businesses at a higher valuation multiple than smaller companies.

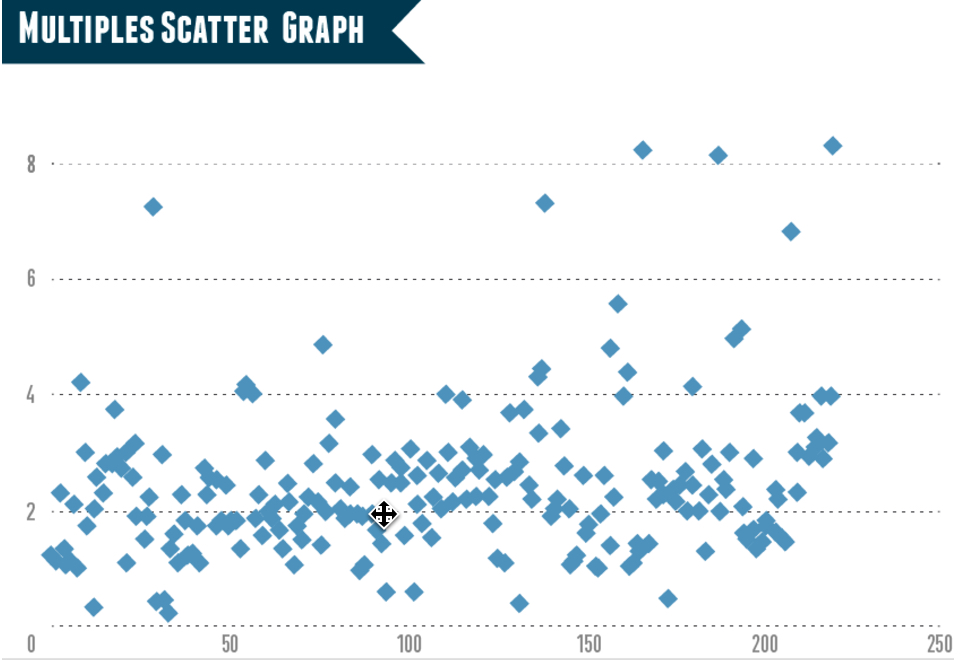

While this is a significant metric, it’s also important to ask – how many of these businesses sold at each price point?

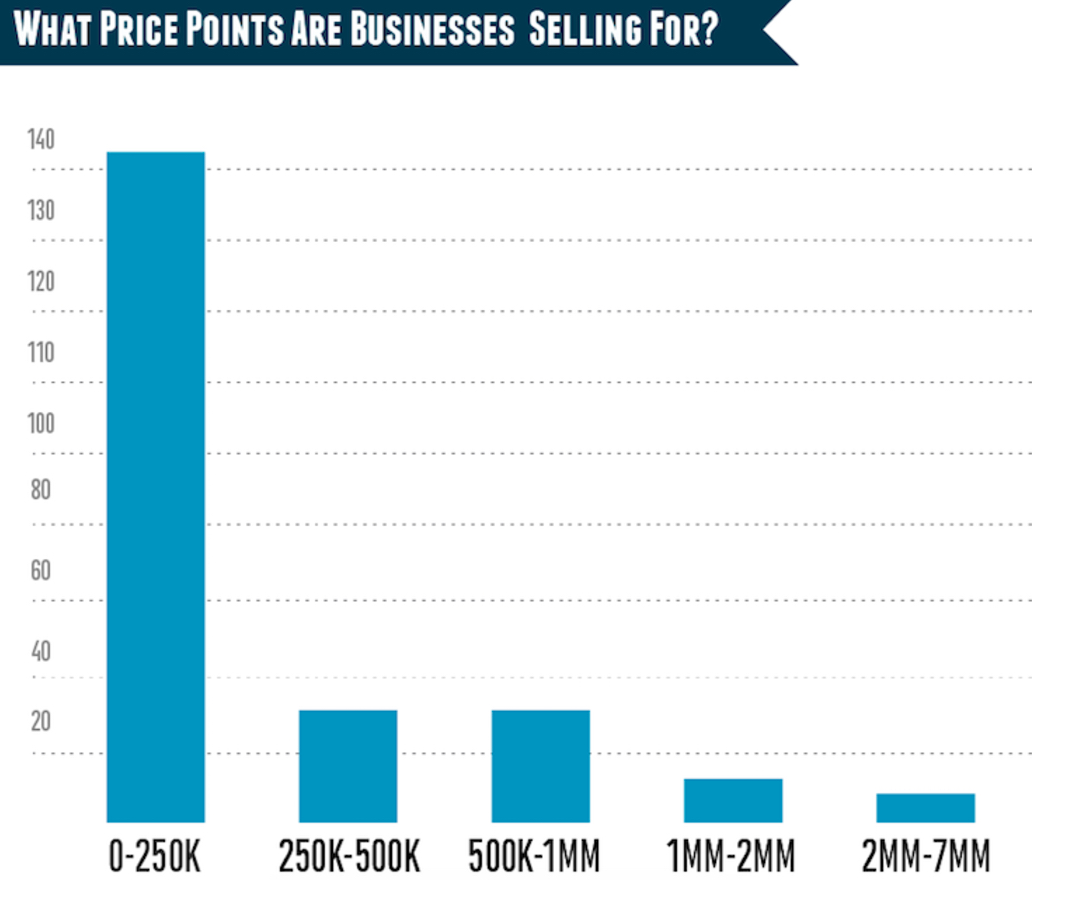

How Many Transactions Occurred at Each Valuation Price Point?

Now this is really interesting. While larger companies sold at a higher valuation multiple, you can see that smaller companies dominated the transactions by an overwhelming amount.

There were a significant number of smaller businesses that sold for less than $250,000 – more specifically 142 companies out of the 234 that we analyzed sit in this range.

And the larger companies? Only 10 of our 234 businesses were in the $2 million+ gross income range.

Some fascinating insights we found:

- ALL of the $2 million+ transactions were in Service or Ecommerce

- Most of the Advertising and Lead Generation transactions sat in the low range of -$250K

- At the top of the scale in the $2MM-$7MM business range, the average transaction was over $6.5 million – with the biggest sale hitting the ceiling at $22MM for an Ecommerce business.

- On the other end of the spectrum in the $0-$250K range, the average transaction was just under $90k – bottoming out at $6,500 for a small Advertising business.