Finding a quality, cost effective manufacturer is not an easy task for businesses. You typically have many different companies ordering from you and you enjoy helping your clients grow. You have been doing this for so long that you could run the business with your eyes closed, but at the end of the day, you have started to wonder to yourself, How much is my manufacturing business worth? A broker can help you find the answer to that question, but understanding the process is always beneficial to you as an owner. After all, your objective is to receive the maximum value for it. And in order to do that, you must first look at the many variables that come into consideration when looking at the possibility of selling your manufacturing business.

In order to show you the different variables, we have taken data from the last decade of all the manufacturers sold in the United States that met our criteria, and broken it down for your further review in order for you to make the right decision on the sale of your business.

What is your manufacturer worth?

The value of your manufacturing business is correlative to your individual business, the market and what potential buyers are willing to pay. A manufacturing business offers a specific product, so being a quality manufacturer that stores can afford makes some better than others. But generally speaking having higher quality products at reasonable prices, allows you to sell to more companies which ultimately increases the value of your business. So while you are trying to figure out how much your business is worth, here are some questions that should be answered before trying to value the price of your business.

- What are the sales?

- What is the profit?

- What are the growth trends?

- What is driving new sales and is that sustainable?

- What channels do new customers come from and what is the breakdown of each channel?

- What is your market position?

- Is your Location favorable?

- How reliant is the business on the owner?

- What systems and processes are in place to run the business?

What makes a manufacturing business worth more?

When a buyer looks at purchasing your business, they are basically looking at their rate of return on their investment. In other words, when will they recover what they have spent on the business? In order to show the prospective buyer that their ROI will be high and their relative risk will be low, you should be able to demonstrate a few key characteristics associated with your manufacture ring business.

And while it is true that the profit and sales are considered very important aspects when considering the purchase of a business, they are not the only factors that can add or decrease the value of your business. The following characteristics will increase the value of your manufacturing business.

- Predictable key drivers of new sales

- Stable or growing traffic from diversified sources

- Established suppliers of inventory with backup suppliers in place

- Traffic stats

- High percentage of repeat visitors and repeat sales

- Clean legal history

- Brand with trademark, copyright or legal concerns

- Documented systems and processes

- Growth potential

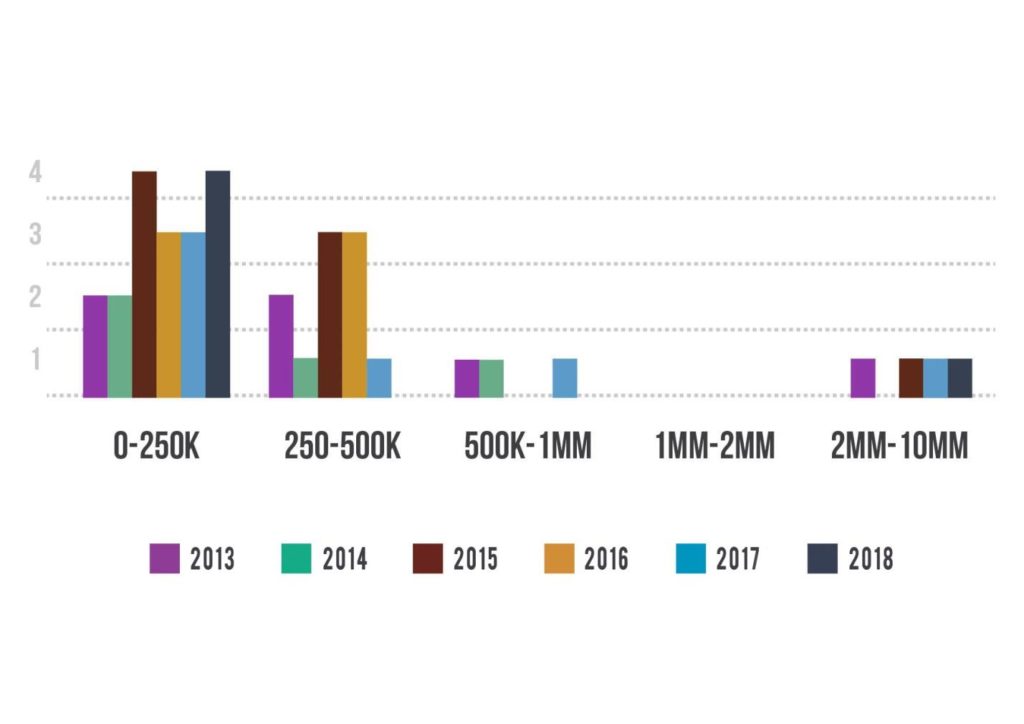

What is the most frequent deal size?

It becomes harder to pinpoint the exact answer to this question because of the fluctuation of the market and trends. But of the data that was collected, the most frequently sized deal is the 0-$250k range. This range has continuously had the most the number of sales, for the last 10 years.

For example in 2018 there were a total of 5 manufacturing businesses sold, and of those 4 were valued at the 0-$250 range. If your business does not fall into that value category, there is someone that will want to buy your business. Finding the right broker will help.

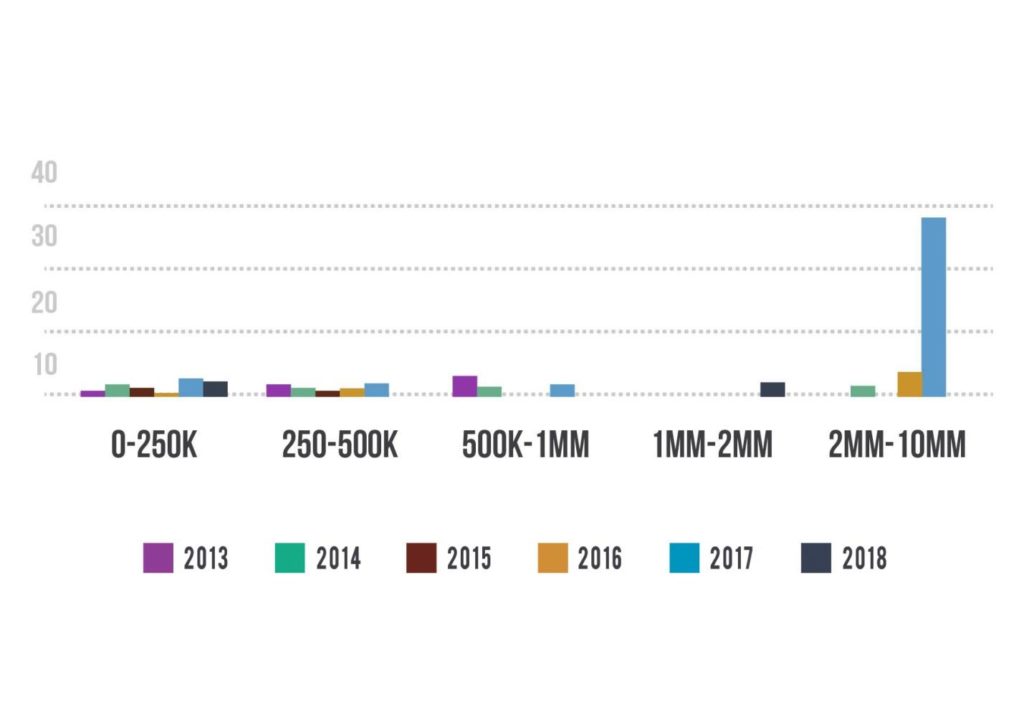

Are bigger businesses worth more?

Generally speaking, yes, larger businesses typically sell for higher multiples. Take a look at the image below, as there is an increase in revenue, your multiple becomes higher, which helps generate a better return on your personal investment.

To help you understand the graph a little better, look at the multiple from 2015 for the valuation price range of 0-$250k, here the average multiple lands right at 2.97x, with a total of 5 manufacturing businesses sold, however when your business’ valuation is in the $1-2 million range the multiple jumps to 3.82x, with 1 manufacturing business being sold. So in the case of this data, the bigger manufacturer has surpassed the 0-$250k range, and has less than half the number of businesses for sale.

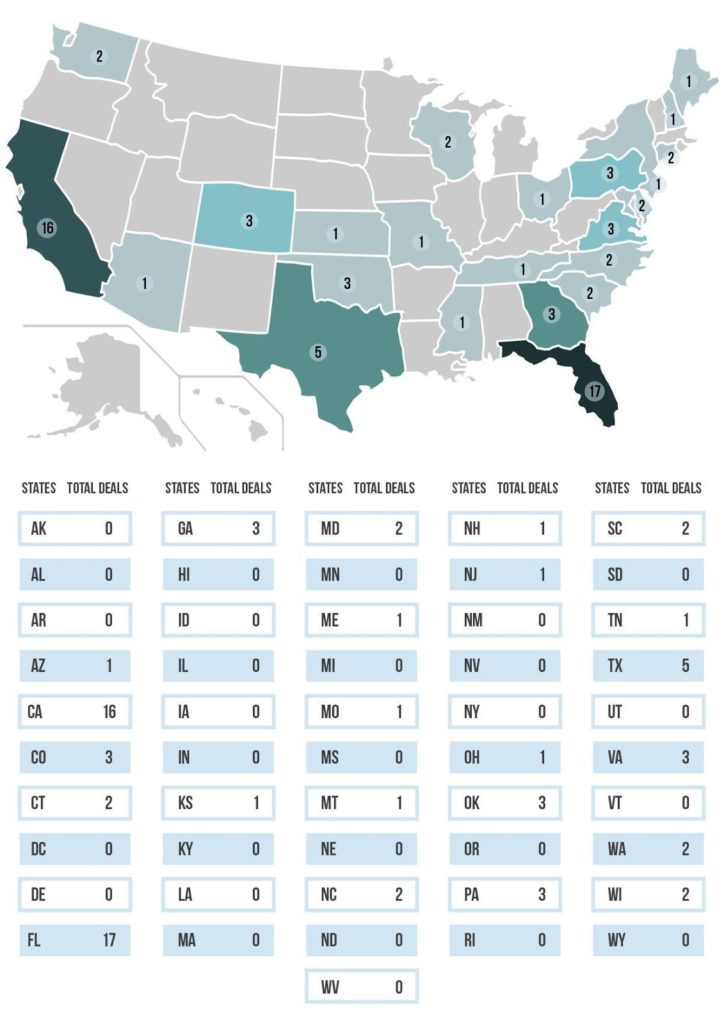

What states have the most manufacturer business deals?

Are you wondering where the most deals were made throughout the country, or if your state has a hot market to sell fast? California holds the win for the most number of manufacturers sold. Keep in mind that California is one of the biggest states in the U.S so naturally there would be more sales completed in the state. But having a business in a smaller state with less sales does not mean that someone isn’t looking acquire a business in your neck of the woods. Having a broker to help you find a buyer for your manufacturer no matter what state you are in, can help you successfully sell your business.

Why would you sell in the first place?

When deciding to sell your business, it can become an overwhelming and difficult decision. Your reasons will always be different from the business owner next door. Maybe you are ready to start a new venture, or you are ready to retire. Whatever your reason is, be sure that you have the necessary knowledge and tools to maximize the value out of your business.

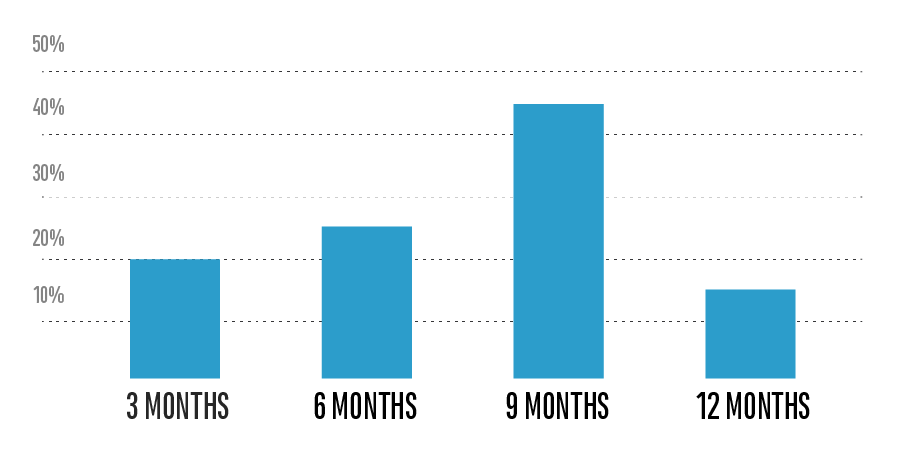

How long will it take to sell your manufacturing business?

There is not one set timeline for the sale of any business. The variables of the individual business and terms of the sale will define how long it will take to sell. Do keep in mind that generally speaking, the larger deals (over $1 million) take longer to sell than the smaller deals (under $200k) due to the complexity of the business, in addition to the risk of purchasing a company that large for the buyer. And try to remember, that your individual business will always sell at a different pace than other manufacturing businesses, and being patient is an essential part in selling.

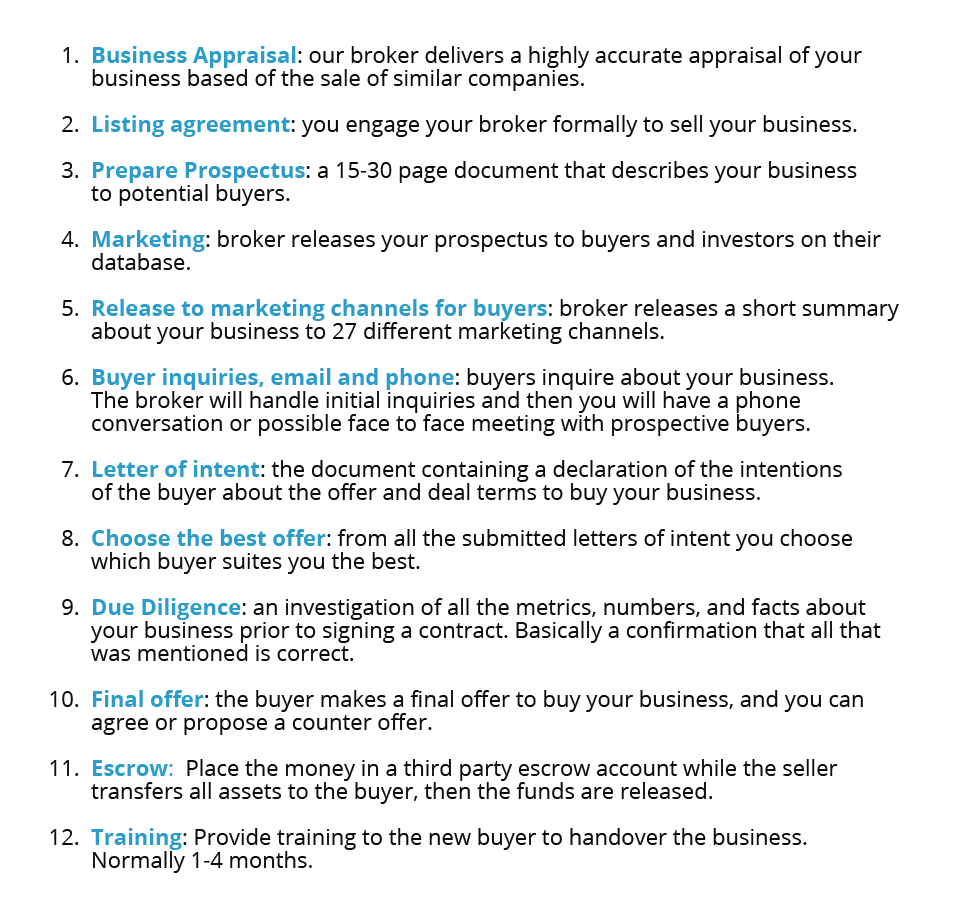

What is the process of selling your manufacturer?

Our step by step process will help you become more confident, when you decide to sell your manufacturer. It’s easy to get confused and lost throughout the process. Doing each and everyone one of these steps will help guide you to capture the maximum value of the sale of your business. If you have questions or concerns about your business’ value or the process in itself please contact us and we will be happy to help.

Who will buy your business?

Finding a buyer can be frustrating and feel like a never ending search, but finding one is essential for the sale of your business. Tuck that frustration and fear aside because there are many options and possibilities. Buyers can range from first time buyers, experienced entrepreneurs, or private equity companies. No matter what the size or maturity of your business there is a buyer for your business, and we can help you find them.

How should I sell my manufacturing business?

Marketplaces – (under $500k yearly profit)

Smaller business and micro-businesses are usually best sold privately by the owner through forums or classified websites.

To sell your manufacturing business, check out:

Broker/M&A Advisor – ($500k – $10m yearly profit)

Medium sized businesses in the $100k-$20m are best sold through brokers who help with finding buyers, negotiating and structuring the deal. To sell your manufacturing business, check out:

Investment Banks – (Over $10m yearly profit)

Larger businesses are best sold through investment banks or merger and acquisition companies. To sell your manufacturing business, check out:

How much will it cost to sell my manufacturing business?

Generally a business broker will charge 8-12% of the sales price of an manufacturing business including inventory depending on the deal size. Larger deals attract a smaller fee. Below is a range of fees at each deal value level.

- Under $1m – 12%

- $1m -$4m – 10%

- $4m -$10m – 8%

- $10m -$25m – 6%

- $25m + – 4%

Conclusion

After reading this article and understanding the necessary steps and processes that come along with the sale of your manufacturing business, and you’ve decided that selling your business is the right decision, we encourage you to have your manufacturer valued by a professional broker; this will ensure that you are receiving maximum value for your business. So when trying to answer that question of what is your business worth, comparing it to the business in the next town over, will not get you the exact answers you seek. When you are ready to take the first step, we will be more than happy to help you find the true value of your manufacturing business, and can help accelerate the sale, by helping you find the right buyer as well. Feel free to fill out our valuation form and get started right away.