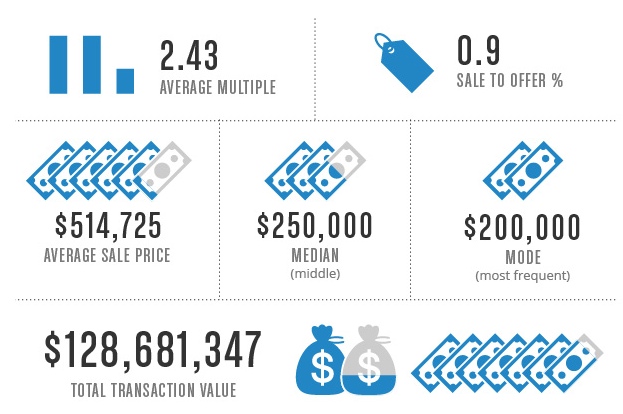

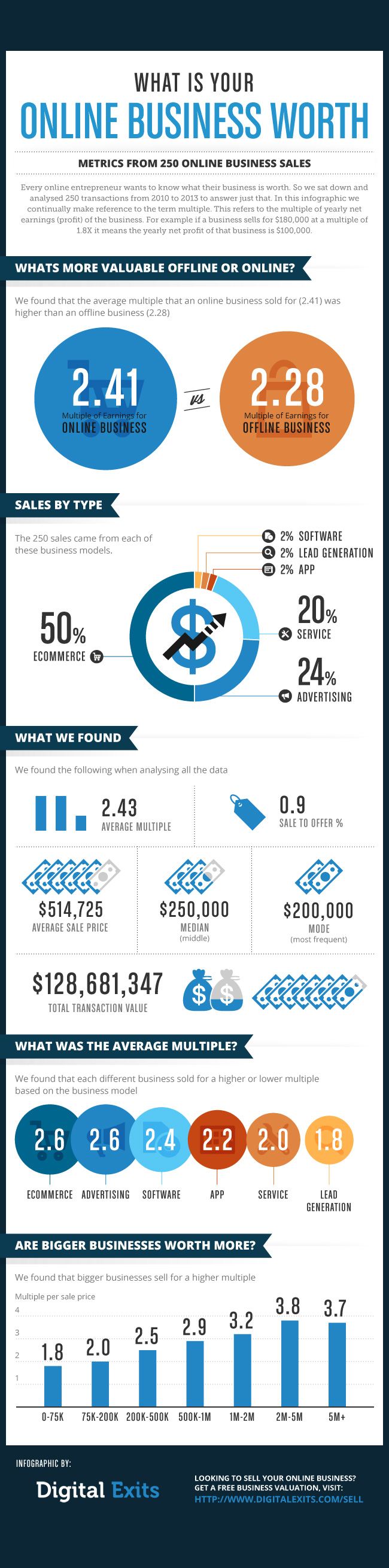

Generally the first question someone asks me when wanting to sell their online business is, “What is it worth?”. So, I sat down and examined the sales of 250 businesses between 2010 and 2012. I also plan to do a follow-up post for all the 2013 data. To answer the question “what is my online business worth?” we use two valuation methods. A multiple of earnings method and a comparable sales method. By definition, the value of something only materialises when a transaction occurs hence the old cliche ‘it’s worth what someone is willing to pay for it’.

A major part of valuation is comparing the sale of similar businesses. When I used to do business valuations for my father’s company Valuator.com.au, a large proportion of the time was spent sourcing similar sales to use as evidence. This was sourced from subscriptions to services like redsquare.com.au and realcommercial.com.au. I picked buybizsell.com to emulate this process for online businesses, I chose them for a few reasons:

- I believe it’s the best representation of the market

- I also believe it is the best business for sale classified website (versus competitors bizquest.com and businessforsale.com)

- You will find most website brokers advertising their listings on bizbuysell.com

- I could buy the data to analyze

We Analyzed 250 Businesses From 6 Business Models

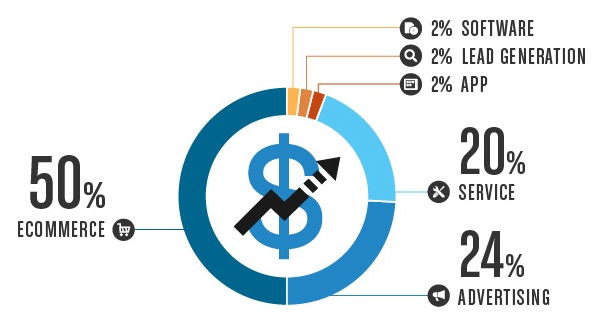

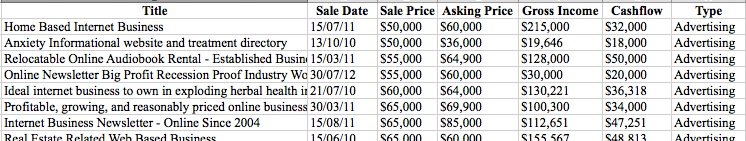

In total we analysed 250 businesses that were sold between 2010 and 2012. A few assumptions were made. We only analyzed businesses with a sale price higher than $50,000 and removed any obvious outliers in the data set (for example: a business that sold for $80,000 that was making $7,000 in profit for the last 12 months). I think this gives a better overall picture. Below is how we categorised each business model:

- Advertising – a website monetized through ads or affiliate offers (24% of businesses analyzed)

- App – a mobile app, monetized through paid downloads, membership or advertising (2% of businesses analyzed)

- Ecommerce – traditional ecommerce stores, drop-shipping and digital products (50% of businesses analyzed)

- Lead Generation – websites monetized through selling leads (2% of businesses analyzed)

- Service – websites monetized through providing a service (20% of businesses analyzed)

- Software – SAAS (software as a service) and any other application based business (2% of businesses analyzed)

What We Found From Our Analysis

How Does Online Compare To Offline?

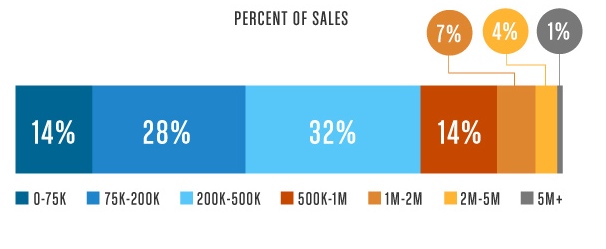

What Was The Selling Price Range?

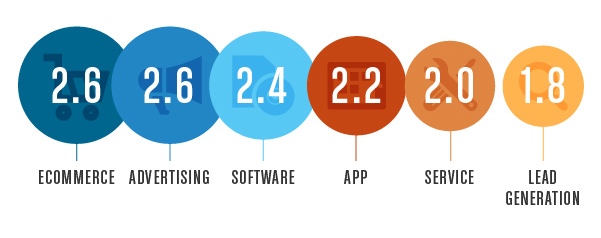

What’s Is The Average Multiple Per Business Model?

We analysed a multiple of net earnings (yearly profit) to compare business models. For example if an ecommerce sold for $520k at a multiple of 2.6X, then the yearly profit was $200k. I think there is a variation between the average multiple that each business models sold for because of a few reasons:

- Workload – time to manage the business each week. The less workload and more systemised, the higher the value

- Profitability – generally a business with more moving parts (operational expenses) costs more to run

- USP – how easily the business model could be copied or replicated. Easy replication resulted in a lower price

- Age – Older businesses are generally more established and pose less risk, therefore demand a higher price

- Risk – buyers thought certain models posed more risk than others. For example a service based business is seen as higher risk because of the higher client churn rate, reliance on service delivery of staff and low barrier to entry.

Here is my thoughts on why there is a differentiation between each business model.

- Advertising – demanded the highest multiple because of the low workload (simple systems) and high margins

- App – although hands off in nature, the businesses are generally quite young and therefore pose a higher risk

- Ecommerce – demanded the highest multiple because of the reduced risk (mainly the tangible customer base)

- Lead Generation – had the lowest multiple because they really add much value to the market place and had a high reliance on SEO traffic

- Service – sold for a lower multiple because of the higher workload and reliance on skilled employees

- Software – had a higher multiple because of the value generated through the technology of the software

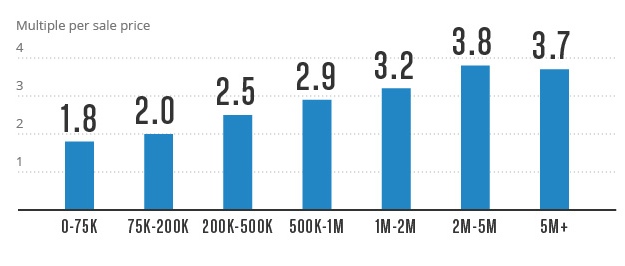

Are Smaller Or Larger Businesses Worth More?

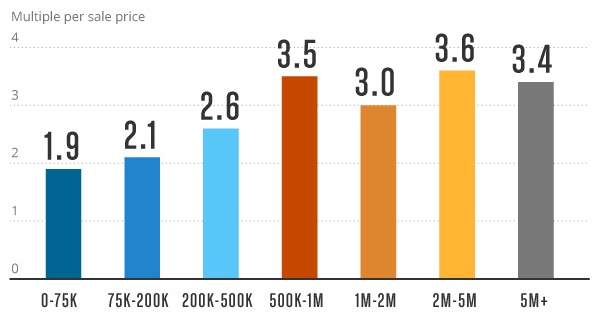

Ecommerce Value Per Sale Price?

What’s in store for 2014 ?

- Valuations Increasing – We are sitting at an average of 2.41X multiple for this report, when I run the 2013 data I predict this increasing to as high as 2.8X multiple. As the general investor market starts to become educated about the possibility of investing online the demand is only going to increase. Similarly the multiple of offline businesses is going to decrease. General market conditions stipulate this. The global economy is struggling and this will be reflective in multiple for offline businesses.

- Ecommerce is only going to grow – As you can see by our data set, ecommerce businesses represent 50% of the data. I think this will be close to 60% in 2013 and it is only going to increase thanks to the growth in ecommerce platforms like shopify and bigcommerce and low barrier to starting your own online store. The general shift in the way we do business to online will also influence this.

- Increase in seller financing – The fact you are yet to be able to get a loan from any bank to purchase an online business spurns creative deal making. I see a steady increase in seller financing and creative deal making to get deals done. Expect to have some type of payment plan as a seller.

- Market Growth – I can only see the growth of online businesses to increase. This is combined with euphoric optimism from most buyers I talk to.

- Flippa Decline – Flippa.com is going to continue to decline in sales, traffic and quality listings. In 2013 we have seen a large shift of sub $50k sites over to website brokers and this will continue at a growing rate. I agree with the views of Justin here. Flippa has no way of filtering listings quality listings at scale and for this factor they are going to struggle.

- Private sales still pose the best deals – we will continue to see the best deals for entrepreneurs buying websites by going direct. Generally if you are looking to buy privately you will pick up a better deal (multiple) than if you go to the market. Drew Sanocki has a great article about when is the right time to buy an online business.

- SEO isn’t going to die – continual Google updates and unreliability of search traffic have forced people to become more open to other traffic sources. This is evident with Demand Media’s business model pivot and purchase of it’s first ecommerce business. However the continual prediction that “SEO is dead” is utter rubbish. Google wouldn’t have spent billions into the research and development of their algorithm to change it overnight. Sure there is going to be a higher influence of social signals in the algorithm, but back links are still going to be a cornerstone of ranking in Google.

- Drop ship is going to die out – with any form of arbitrage, eventually it get’s found out and more competitors move into the space making it no longer viable. Drop shipping products doesn’t add an value to the market. Although being a middle man is a perfectly legitimate business model, drop shipping adds no real value to the market unless you are able to create a brand, USP or personality around your business.

- Clicks and Bricks – the future of ecommerce is “clicks and bricks” this is something that Ian Schoen first introduced me too, terry and Ian talk about that in episode #76 of the buildmyonlinestore.com podcast. Clicks and bricks is a traditional retailer using online as their main marketing channel, while still having a physical warehouse, but no shopfront. This is the exact business model that Amazon uses.

- Investment firms increasing investment – the investment world is waking up. Whether they are buying for cashflow or process, the general investor market is starting to continually snap up of sub $5million deals.

- Small websites become more valuable – simple economics states that if there is more demand for a smaller business then the price is going to be larger. I predict there is going to be an increase in the multiple paid for sub $200k valued sites from 1.8X earnings to 2.5X net earnings in 2013.

- USP when selling – If you have the time and the audience you are always going to get a higher offer selling yourself, just like Andrew Youderian did with his trolling motors store. Or Dan Taylor in selling his Saas app. A strategic exit is always going to bring a higher selling price than a financial exit.

Do We Have New Reports?

Yes check out our most recent valuation reports:

What Questions Do You Have ?

I hope you got some value from my analysis of what your online business is worth. But I want to hear about how YOU plan on using this data when selling your business or any questions you have. Don’t be shy: drop a comment below right now and share the love!

Here is a link to the infograhic: Click here