Business people who are looking to sell their consulting business usually underestimate the complexities involved in the whole sale process. As a result, they frequently sell their businesses for a price that is lower than fair value, wasting an excellent opportunity for making a good amount of money.

Generally consulting companies can be defined as a consulting company that provides consulting services. There are a lot of businesses like that in the United States and it’s hard to calculate the exact number, but it’s correct to assume that while there are many small firms, there are also large ones that are very attractive to young consulting students.

When a Consulting business owner decides to sell their business, it possible to execute an outright sale or merge it to another consulting business. But why is this happening? The simplest explanation is that one company has something to offer that the other company wants. Sometimes there are mega-mergers which changes the way people do business in the US.

Take a look at these tips and learn how to sell your business for the best price:

What is your Consulting Business worth?

The first thing you have to do is understand how the sale process really works. Don’t underestimate it and don’t try to take short cuts either, otherwise you won’t get the money you deserve.

Then, gather all financial data from the past three to five years. Prepare a report with all information and provide your potential buyers whenever they ask.

A Consulting business is very difficult to run, after all there are a lot of moving pieces. A professional broker can help you calculate the exact value of your consulting company. In this case, a business broker could be very handy.

But if you really want to do the math all by yourself, there’s no problem. Take a look at these metrics and make sure you have all the answers:

- What are the sales?

- What is the profit?

- What are the growth trends?

- What is driving new sales and is that sustainable?

- What channels do new customers come from and what is the breakdown of each channel?

- What is your market position?

- Is your Location favorable?

- How reliant is the business on the owner?

- What systems and processes are in place to run the business?

After all, understanding what potential buyers want is essential to the success of any business transaction. They would like to be aware of the quality of management, evidence of strong and consistent revenue growth, retention of key clients as well as market presence.

What makes a Consulting business worth more?

You have already analyzed and calculated what your consulting business is worth, but the math is not over. Now you must factor in various elements that can change the value of your business. But don’t worry, if you have no idea of what I’m talking about, keep these guidelines close to you and everything will be crystal clear.

- Predictable key drivers of new sales

- Stable or growing traffic from diversified sources

- Established suppliers of inventory with backup suppliers in place

- Traffic stats

- High percentage of repeat visitors and repeat sales

- Clean legal history

- Brand with trademark, copyright or legal concerns

- Documented systems and processes

- Growth potential

But if you still have questions, you can always reach out for professional help. The most important thing is to know exactly which aspects of your consulting business make your business more valuable.

What does the average Consulting business sell for?

Before analyzing the last 10 years numbers, two important details: the first one is that 2018 data is not complete, as the last consulting business sold that is cited in our research is from July.

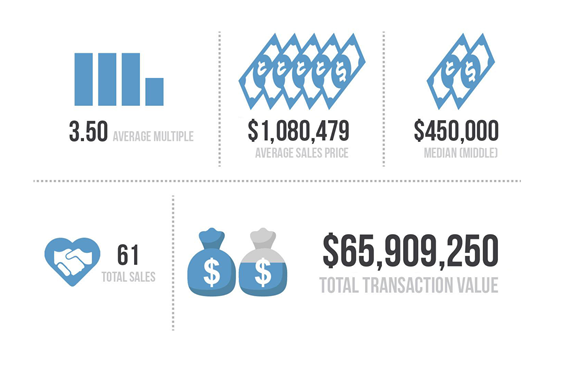

The second is, since there were very few consulting business sold (only 61), the average multiple and average sales price are bigger than it normally would be, respectively 3.50x and $890k.

Those are particularly high numbers, and a multiple of 3.50x means the average asking price is almost four times higher than average gross income.

What is the most frequent deal size?

But don’t be impressed. The multiple data may be high, but most frequent deal size is approximately half of it ($450k). And why is that?

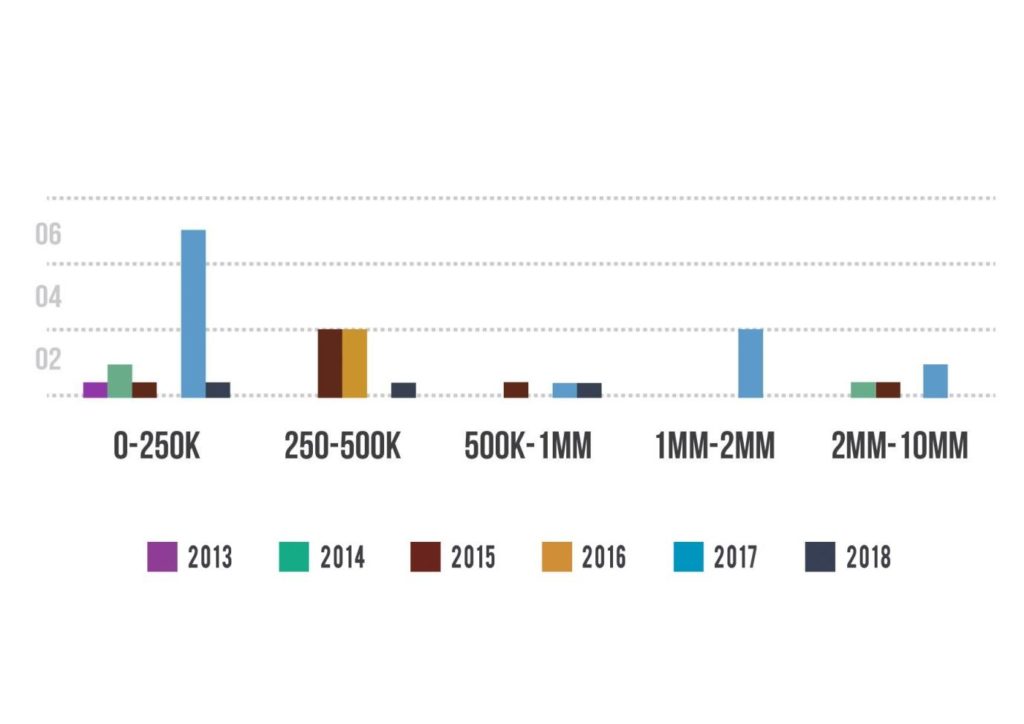

If you take a look at the chart, you’ll see most of consulting business sold in the past five years were negotiated for less than $250k. In second place is $250-500k deal size.

The higher the price typically means the higher the multiple. But frequency is much lower than the smallest categories as well.

Is the Consulting business market getting bigger?

It’s hard to say. 2017 had an excellent year for consulting business, but the same cannot be said about 2016’s numbers. The best year so far was 2012, the total transaction value almost reached $20 million in sales.

There are good and bad years, though, so it’s correct to say that the market for consulting companies has its ups and downs.

Are bigger businesses worth more?

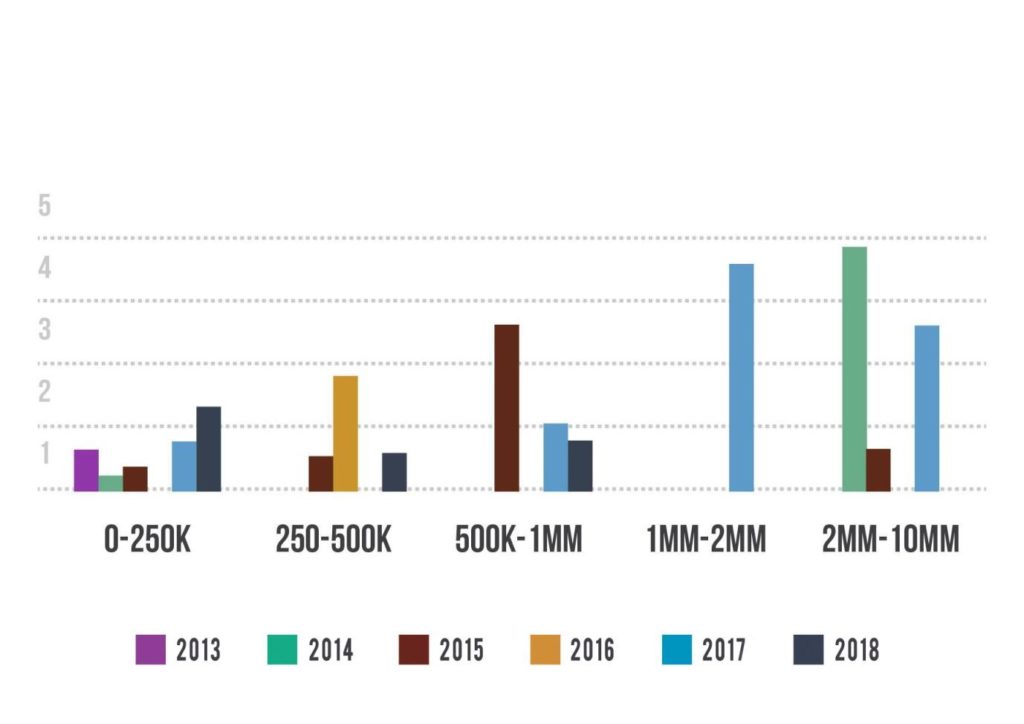

Yes. “Bigger is better”. That’s why there are so many mergers of Consulting companies taking place.

At the same time, the higher the deal size, the higher the multiple, the higher the profit. Keep that in mind before setting your asking price.

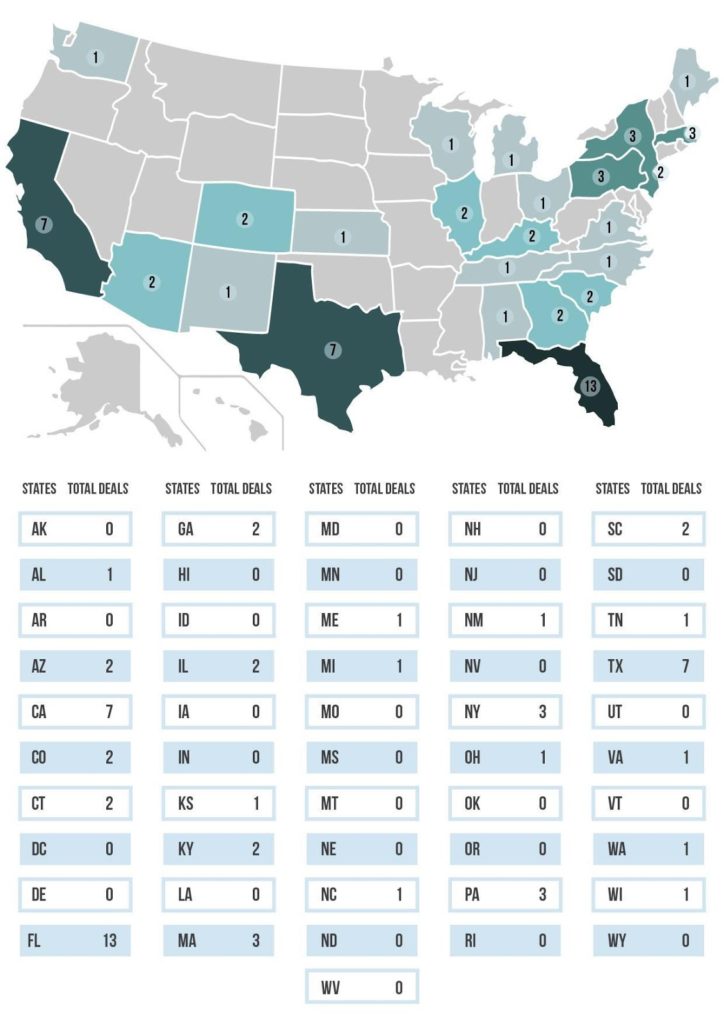

What states have the most Consulting business deals?

California, Florida and Texas — the three most populated states in the US — are the best places to negotiate a Consulting business sale.

Why would you sell in the first place?

The reason to sell always varies from each person. Maybe you are looking for new challenges, businesses and opportunities, or you just want to enjoy your family and retire. Although it can seem tempting to get your hard worked cash, make sure that you are clear on the motives so you don’t regret afterwards.

How long will it take to sell your Consulting business?

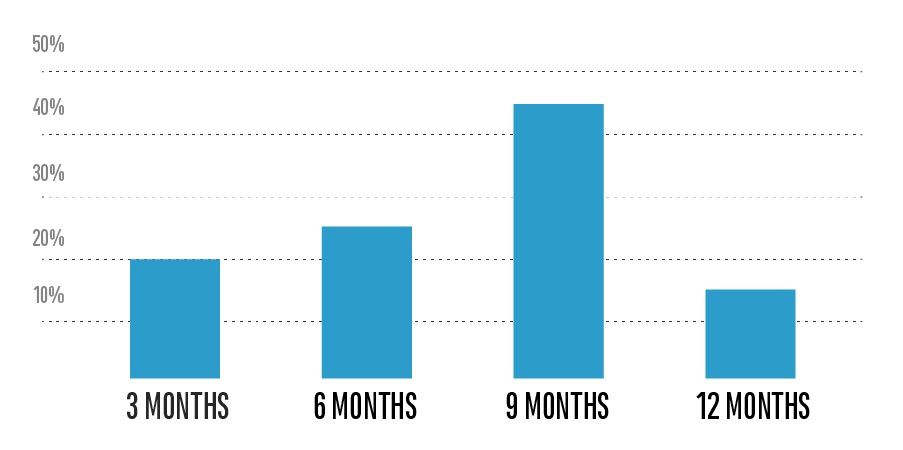

If you have read all the necessary steps to understand your valuation, and think you have focused on all the topics that make your company worth more, it is maybe time to start the process. Selling your business is a long-term process, and doesn’t happen overnight. Usually companies sell in 9 months, but you can also see deals getting closed in 3 to 6 months depending on the opportunity.

What is the process of selling your Consulting business?

This step by step process will help sale process. Many entrepreneurs forget about a step, or just don’t have the right guidance to know all the stages necessary and get lost through the process. Don’t forget to go through all of these, and if you have any questions, comment at the end of the article or contact us for more help.

Who will buy your business?

If you are wondering about the buyers that can be interested in your Consulting business, don’t worry, there are many options and possibilities. From First Time entrepreneurs, to businessmen interested in new opportunities, the chances are that in the consulting industry it may likely be a person who already has experience in the field.

How should I sell my consulting business?

Marketplaces – (under $500k yearly profit)

Smaller business and micro-businesses are usually best sold privately by the owner through forums or classified websites.

To sell your consulting business, check out:

Broker/M&A Advisor – ($500k – $10m yearly profit)

Medium sized businesses in the $100k-$20m are best sold through brokers who help with finding buyers, negotiating and structuring the deal. To sell your consulting business, check out:

Investment Banks – (Over $10m yearly profit)

Larger businesses are best sold through investment banks or merger and acquisition companies. To sell your consulting business, check out:

How much will it cost to sell my consulting business?

Generally a business broker will charge 8-12% of the sales price of an consulting business including inventory depending on the deal size. Larger deals attract a smaller fee. Below is a range of fees at each deal value level.

- Under $1m – 12%

- $1m -$4m – 10%

- $4m -$10m – 8%

- $10m -$25m – 6%

- $25m + – 4%

Conclusion

There have been very few consulting business sold in the past 10 years, but the asking price of those 61 businesses is high enough, as the multiple is 3.5x.

That means consulting business can be very profitable. If you want to start accelerating your buyout process, fill out our free valuation form and get your business valued today! Leave your comments on any doubts or feedback, we are glad to hear your thoughts!